Publication 1542 Per Diem Rates (For Travel Within The Continental United States)

ADVERTISEMENT

Contents

Department of the Treasury

Internal Revenue Service

Introduction ........................................................

1

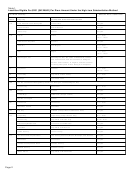

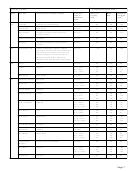

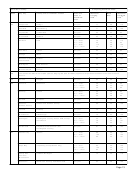

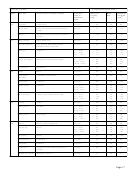

Table 1. Localities Eligible for $201 ($42

Publication 1542

M&IE) Per Diem Amount Under the

(Rev. April 2000)

High-Low Substantiation Method ..............

2

Cat. No. 12684I

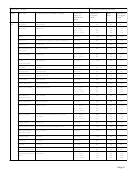

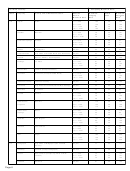

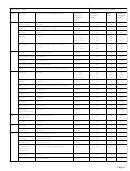

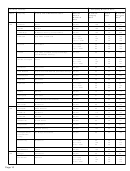

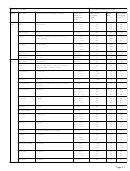

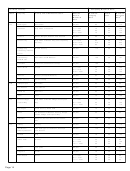

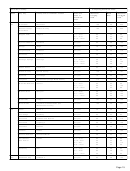

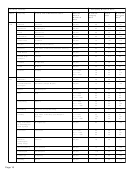

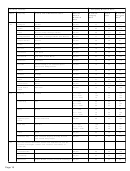

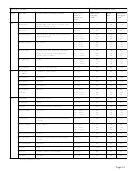

Table 2. Maximum Federal Per Diem Rates ....

4

Per Diem

How To Get More Information ..........................

21

Rates

Introduction

This publication is for employers who pay a per diem

(For Travel Within the

allowance to employees for business travel away from

home on or after January 1, 2000, within the continental

Continental United

United States (CONUS).

It gives the maximum per

diem rate you can use without treating part of the per

States)

diem allowance as wages for tax purposes. For a de-

tailed discussion on the tax treatment of a per diem

allowance, see chapter 16 of Publication 535, Business

Expenses, or Revenue Procedure 2000–9, 2000–2

I.R.B. 1.

High-low method. Table 1, Localities Eligible for $201

($42 M&IE) Per Diem Amount Under the High-Low

Substantiation Method lists the localities that are treated

under that method as high cost localities for 2000 or the

part of the year shown in column 4. Table 1 is on pages

2 and 3. All other localities within CONUS are eligible

for $124 ($34 meals and incidental expenses (M&IE))

per diem under the high-low method.

Regular federal per diem rate method.

Table 2,

Maximum Federal Per Diem Rates, gives the regular

federal per diem rate, including the separate rate for

meals and incidental expenses (M&IE) for each locality.

Table 2 begins on page 4. The standard rate for all

locations within CONUS not specifically listed in Table

2 is $85 ($55 for lodging and $30 for M&IE). A federal

agency can ask the General Services Administration to

review the per diem rate in a particular locality. The

process is described in footnote 4 of the table.

Travel outside CONUS. The federal per diem rates

for localities outside CONUS, including Alaska, Hawaii,

Puerto Rico, the Northern Mariana Islands, U.S. pos-

sessions, and all foreign localities, are published

monthly. You can buy the per diem supplement, Maxi-

mum Travel Per Diem Allowances for Foreign Areas,

from the U.S. Government Printing Office. Call (202)

512–1800 (not a toll-free number) or write: U.S. Gov-

ernment Printing Office, P.O. Box 371954, Pittsburgh,

PA 15250–7974.

Per diem rates on the internet. You can access the

federal per diem rates on the internet.

•

The rates for travel within CONUS are at:

•

The rates for travel outside CONUS are at:

or gopher://gopher.state.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22