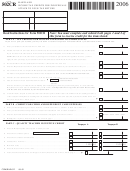

MARYLAND

FORM

Page 2

INCOME TAX CREDITS FOR INDIVIDUALS

502CR

2010

NAME ______________________________ SSN _______________________________

10502C150

PART D - CREDIT FOR AQUACULTURE OYSTER FLOATS

Enter the amount paid to purchase an aquaculture oyster float(s)

1.

Enter here and on line 4 of Part G below . This credit is limited. See Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

PART E - LONG-TERM CARE INSURANCE CREDIT: (This is a ONE-TIME credit)

Answer the questions and see instructions below before completing Columns A through E for each person for whom you paid long-term care insurance premiums .

Question 1 - Did the insured individual have long-term care insurance prior to July 1, 2000? . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Question 2 - Is the credit being claimed for the insured individual in this year by any other taxpayer? . . . . . . . . . . . . . . . . . . . .

Yes

No

Question 3 - Has credit been claimed by anyone for the insured individual in any other tax year? . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If you answered YES to any of the above questions, that insured person does NOT qualify for the credit.

Complete Columns A through D only for insured individuals who qualify for credit . Enter in Column E the lesser of the amount of premium paid for each insured person or:

$330 for those insured that are 40 or less, as of 12/31/10

$500 for those insured that are over age 40, as of 12/31/10 .

Add the amounts in Column E and enter the total on line 5 (TOTAL) and Part G, line 5 .

Column A

Column B

Column C

Column D

Column E

Name of Qualifying Insured Individual

Age

Social Security No. of Insured

Relationship to Taxpayer

Amount of Premium Paid

Credit Amount

1.

1.

2.

2.

3.

3.

4.

4.

5. TOTAL

5.

PART F - CREDIT FOR PRESERVATION AND CONSERVATION EASEMENTS

Taxpayer A

Taxpayer B

Enter the portion of the total current year donation amount, and any carryover

1.

from prior year(s), attributable to each taxpayer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1

Enter the amount of any payment received for the easement by each

2.

taxpayer during 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3

3.

Enter the amount from line 24 of Form 502; line 32c of Form 505; line 33 of Form 515;

4.

4

line 30 of Form 504; or $5,000, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Enter the lesser of lines 3 or 4 here . (If you itemize deductions, see Instruction 14 .) . . . . . . .

5

5

5.

6. Total (Add amounts from line 5 for taxpayers A and B) . Enter here and on line 6 Part G below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 . Excess credit carryover . Subtract line 6 from the sum of lines 3A and 3B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

PART G - INCOME TAX CREDIT SUMMARY

Enter the amount from Part A, line 8 (If more than one state, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1.

Enter the amount from Part B, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2.

Enter the amount from Part C, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3.

4

Enter the amount from Part D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter the amount from Part E, line 5

5

5.

6

Enter the amount from Part F, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

Enter the amount from Section 2, line 4 of Form 502H . Attach Form 502H . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7.

Total (Add lines 1 through 7) Enter this amount on line 27 of Form 502; line 39 of Form 504; line 35 of Form 505; or line 36 of Form 515 . .

8

8.

PART H - REFUNDABLE INCOME TAX CREDITS

Neighborhood Stabilization Credit . Enter the amount and attach certification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1.

Heritage Structure Rehabilitation and/or Sustainable Communities Tax Credits (See instructions for Forms 502H and 502S . ) Attach certification .

2

2.

Refundable Business Income Tax Credit (See instructions for Form 500CR) Attach 500CR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3.

IRC Section 1341 Repayment Credit . (See Instructions) Attach documentation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4.

Form 1041 Schedule K-1 Nonresident PTE tax (See instructions for required attachments) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5.

Total (Add lines 1 through 5) . Enter this amount on line 44 of Form 502; line 47 of Form 505; or line 54 of Form 515 . . . . . . . . . . . . . .

6.

6

COM/RAD-012

10-50

1

1 2

2 3

3 4

4 5

5