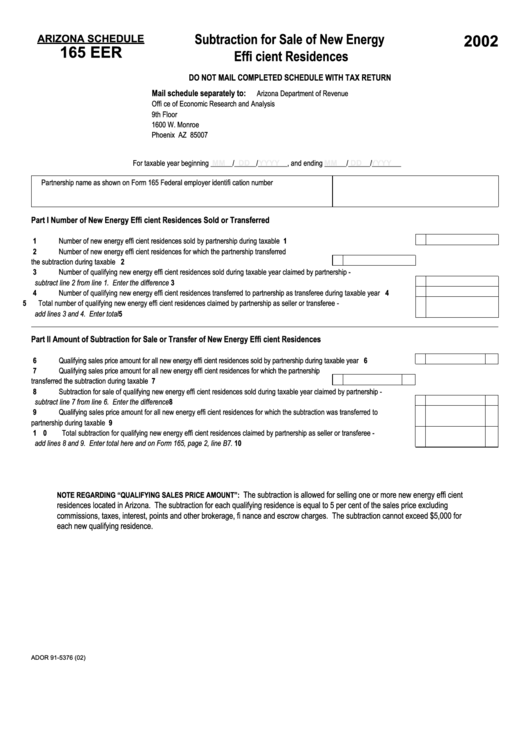

Arizona Schedule 165 Eer - Subtraction For Sale Of New Energy Efficient Residences - 2002

ADVERTISEMENT

Subtraction for Sale of New Energy

ARIZONA SCHEDULE

2002

165 EER

Effi cient Residences

DO NOT MAIL COMPLETED SCHEDULE WITH TAX RETURN

Mail schedule separately to:

Arizona Department of Revenue

Offi ce of Economic Research and Analysis

9th Floor

1600 W. Monroe

Phoenix AZ 85007

MM

MM

DD

DD

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

For taxable year beginning ______/______/________, and ending ______/______/________

Partnership name as shown on Form 165

Federal employer identifi cation number

Part I

Number of New Energy Effi cient Residences Sold or Transferred

1 Number of new energy effi cient residences sold by partnership during taxable year......................................................................

1

2 Number of new energy effi cient residences for which the partnership transferred

the subtraction during taxable year...................................................................................................

2

3 Number of qualifying new energy effi cient residences sold during taxable year claimed by partnership -

subtract line 2 from line 1. Enter the difference ..............................................................................................................................

3

4 Number of qualifying new energy effi cient residences transferred to partnership as transferee during taxable year .....................

4

5 Total number of qualifying new energy effi cient residences claimed by partnership as seller or transferee -

add lines 3 and 4. Enter total ..........................................................................................................................................................

5

Part II

Amount of Subtraction for Sale or Transfer of New Energy Effi cient Residences

6 Qualifying sales price amount for all new energy effi cient residences sold by partnership during taxable year .................................

6

7 Qualifying sales price amount for all new energy effi cient residences for which the partnership

transferred the subtraction during taxable year ................................................................................

7

8 Subtraction for sale of qualifying new energy effi cient residences sold during taxable year claimed by partnership -

subtract line 7 from line 6. Enter the difference ..............................................................................................................................

8

9 Qualifying sales price amount for all new energy effi cient residences for which the subtraction was transferred to

partnership during taxable year .......................................................................................................................................................

9

10 Total subtraction for qualifying new energy effi cient residences claimed by partnership as seller or transferee -

add lines 8 and 9. Enter total here and on Form 165, page 2, line B7. .........................................................................................

10

The subtraction is allowed for selling one or more new energy effi cient

NOTE REGARDING “QUALIFYING SALES PRICE AMOUNT”:

residences located in Arizona. The subtraction for each qualifying residence is equal to 5 per cent of the sales price excluding

commissions, taxes, interest, points and other brokerage, fi nance and escrow charges. The subtraction cannot exceed $5,000 for

each new qualifying residence.

ADOR 91-5376 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1