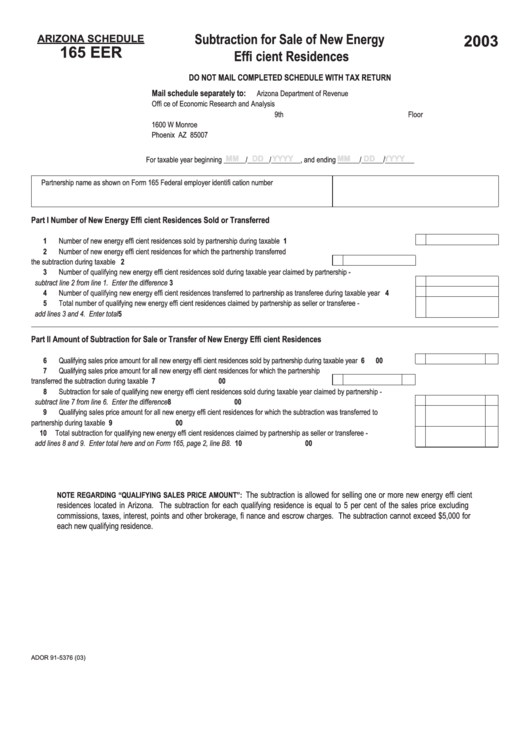

Arizona Schedule 165 Eer - Subtraction For Sale Of New Energy 2003 Effi Cient Residences - 2003

ADVERTISEMENT

2003

ARIZONA SCHEDULE

Subtraction for Sale of New Energy

165 EER

Effi cient Residences

DO NOT MAIL COMPLETED SCHEDULE WITH TAX RETURN

Mail schedule separately to:

Arizona Department of Revenue

Offi ce of Economic Research and Analysis

9th Floor

1600 W Monroe

Phoenix AZ 85007

MM

MM

DD

DD

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

For taxable year beginning ______/______/________, and ending ______/______/________

Partnership name as shown on Form 165

Federal employer identifi cation number

Part I

Number of New Energy Effi cient Residences Sold or Transferred

1 Number of new energy effi cient residences sold by partnership during taxable year......................................................................

1

2 Number of new energy effi cient residences for which the partnership transferred

the subtraction during taxable year...................................................................................................

2

3 Number of qualifying new energy effi cient residences sold during taxable year claimed by partnership -

subtract line 2 from line 1. Enter the difference ..............................................................................................................................

3

4 Number of qualifying new energy effi cient residences transferred to partnership as transferee during taxable year .....................

4

5 Total number of qualifying new energy effi cient residences claimed by partnership as seller or transferee -

add lines 3 and 4. Enter total ..........................................................................................................................................................

5

Part II

Amount of Subtraction for Sale or Transfer of New Energy Effi cient Residences

6 Qualifying sales price amount for all new energy effi cient residences sold by partnership during taxable year .................................

6

00

7 Qualifying sales price amount for all new energy effi cient residences for which the partnership

transferred the subtraction during taxable year ................................................................................

7

00

8 Subtraction for sale of qualifying new energy effi cient residences sold during taxable year claimed by partnership -

subtract line 7 from line 6. Enter the difference ..............................................................................................................................

8

00

9 Qualifying sales price amount for all new energy effi cient residences for which the subtraction was transferred to

partnership during taxable year .......................................................................................................................................................

9

00

10 Total subtraction for qualifying new energy effi cient residences claimed by partnership as seller or transferee -

add lines 8 and 9. Enter total here and on Form 165, page 2, line B8. .........................................................................................

10

00

The subtraction is allowed for selling one or more new energy effi cient

NOTE REGARDING “QUALIFYING SALES PRICE AMOUNT”:

residences located in Arizona. The subtraction for each qualifying residence is equal to 5 per cent of the sales price excluding

commissions, taxes, interest, points and other brokerage, fi nance and escrow charges. The subtraction cannot exceed $5,000 for

each new qualifying residence.

ADOR 91-5376 (03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1