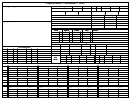

Form Ms-1 - Summary Inventory Of Valuation - 2000 Page 6

ADVERTISEMENT

MS-1

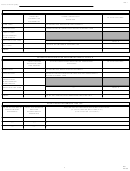

Name of Village District:

LAND

NUMBER

(Lines 1A, B, C & D) - List all improved and unimproved land

2000

For Use By

OF ACRES

ASSESSED

Dept. of Revenue

(include wells, septics & paving)

1. A - 1. F

VALUATION

(Prior Year

BUILDINGS

(Lines 2 A, B & C) - List all buildings

Valuation)

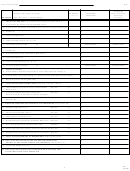

1.

VALUE OF LAND ONLY - Exclude Amount Listed in Lines 3A, 3B & 4

$

A. Current Use (At Current Use Values)(RSA 79-A)

$

B. Conservation Restriction Assessment (At Current Use Values) (RSA 79-B)

$

C. Residential

$

D. Commercial/Industrial

$

E. Total of Taxable Land (A + B + C + D)

F. Tax exempt & Non-Taxable

($

)

XXXXXXXXXX

XXXXXXXXXX

2.

VALUE OF BUILDINGS ONLY - Exclude Amount Listed on Lines 3A, 3B & 4

$

A. Residential

$

B. Manufactured Housing as defined In RSA 674:31

$

C. Commercial/Industrial

$

D. Total of Taxable Buildings (A + B + C)

E. Tax Exempt & Non-Taxable

($

)

XXXXXXXXXX

XXXXXXXXXX

3.

PUBLIC UTILITIES

$

A. Public Utilities (Total of Utilities within District included in instructions)

$

B. Public Utilities (Total of Utilities within district not included in instructions)

$

4.

Mature Wood and Timber (RSA 79:5)

$

5. VALUATION BEFORE EXEMPTIONS (Total of 1E + 2D +3A + 3B + 4)

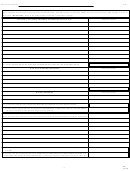

6.

Improvedments to Assest Persons with Disabilities

(Number

) $

$

RSA 72:37-a

7. School Dining/Dormitory/Kitchen Exemption

(Number

) $

$

RSA 72:23,IV (Up to Standard Exemption $150,000)

8. Water/Air Pollution Control Exemption

(Number

) $

$

RSA 72:12-a

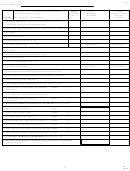

9. MODIFIED ASSESSED VALUATION OF ALL PROPERTIES (Line 5 minus 6-8)

$

$

10. Blind Exemption RSA 72:37

(Number

) $

$

11. Elderly Exemption RSA 72:39-a

(Number

) $

$

12. Disabled Exemption RSA 72:37-b

(Number

) $

$

13. Woodheating Energy Systems Exemption RSA 72:70

(Number

) $

$

14. Solar Energy Systems Exemption RSA 72:62

(Number

) $

$

15. Wind Powered Energy Systems Exemption RSA 72:66 (Number

) $

$

16. Additional School Dining/Dormitory/Kitchen Exemption (Number

) $

$

17. TOTAL DOLLAR AMOUNT OF EXEMPTIONS (Total of Lines 10-16)

18. NET VALUATION ON WHICH THE TAX RATE FOR THE DISTRICT IS COMPUTED

$

(Line 9 minus 17)

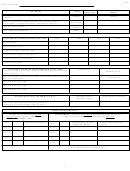

MS-1

6

Rev. 8/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6