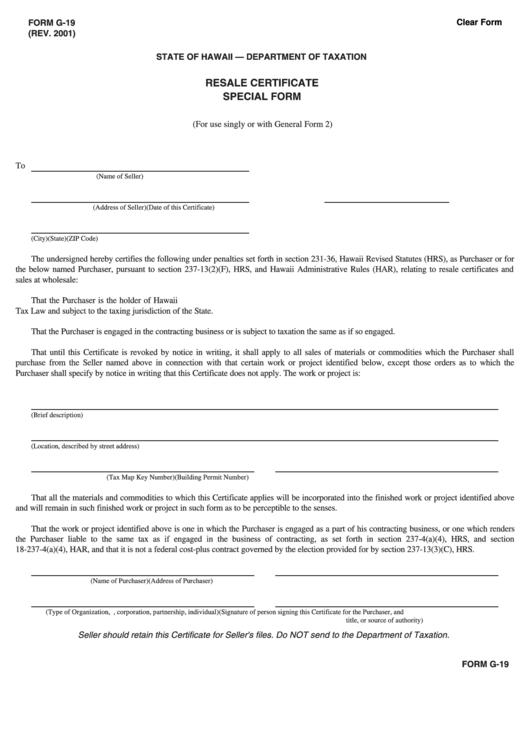

Clear Form

FORM G-19

(REV. 2001)

STATE OF HAWAII — DEPARTMENT OF TAXATION

RESALE CERTIFICATE

SPECIAL FORM

(For use singly or with General Form 2)

To

(Name of Seller)

(Address of Seller)

(Date of this Certificate)

(City)

(State)

(ZIP Code)

The undersigned hereby certifies the following under penalties set forth in section 231-36, Hawaii Revised Statutes (HRS), as Purchaser or for

the below named Purchaser, pursuant to section 237-13(2)(F), HRS, and Hawaii Administrative Rules (HAR), relating to resale certificates and

sales at wholesale:

That the Purchaser is the holder of Hawaii G.E./Use Identification No. ___________________________________ under the General Excise

Tax Law and subject to the taxing jurisdiction of the State.

That the Purchaser is engaged in the contracting business or is subject to taxation the same as if so engaged.

That until this Certificate is revoked by notice in writing, it shall apply to all sales of materials or commodities which the Purchaser shall

purchase from the Seller named above in connection with that certain work or project identified below, except those orders as to which the

Purchaser shall specify by notice in writing that this Certificate does not apply. The work or project is:

(Brief description)

(Location, described by street address)

(Tax Map Key Number)

(Building Permit Number)

That all the materials and commodities to which this Certificate applies will be incorporated into the finished work or project identified above

and will remain in such finished work or project in such form as to be perceptible to the senses.

That the work or project identified above is one in which the Purchaser is engaged as a part of his contracting business, or one which renders

the Purchaser liable to the same tax as if engaged in the business of contracting, as set forth in section 237-4(a)(4), HRS, and section

18-237-4(a)(4), HAR, and that it is not a federal cost-plus contract governed by the election provided for by section 237-13(3)(C), HRS.

(Name of Purchaser)

(Address of Purchaser)

(Type of Organization, e.g., corporation, partnership, individual)

(Signature of person signing this Certificate for the Purchaser, and

title, or source of authority)

Seller should retain this Certificate for Seller's files. Do NOT send to the Department of Taxation.

FORM G-19

1

1