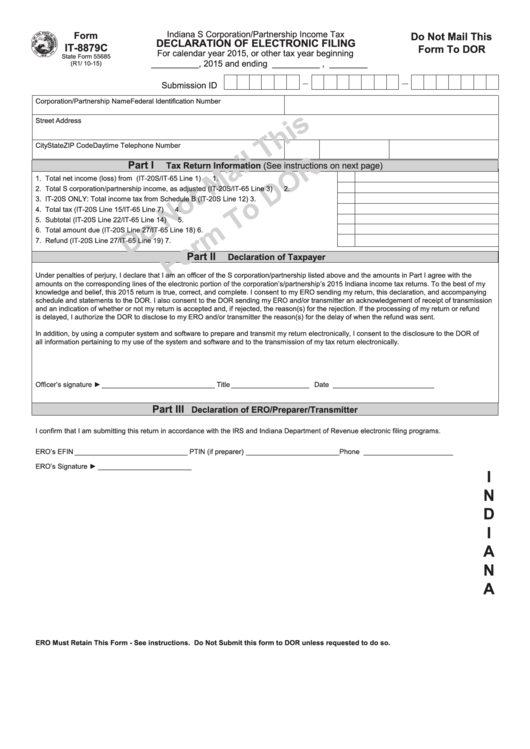

Form It-8879c - Declaration Of Electronic Filing - 2015

ADVERTISEMENT

Indiana S Corporation/Partnership Income Tax

Form

Do Not Mail This

DECLARATION OF ELECTRONIC FILING

IT-8879C

Form To DOR

For calendar year 2015, or other tax year beginning

State Form 55685

__________ , 2015 and ending __________ , ________

(R1/ 10-15)

Submission ID

Corporation/Partnership Name

Federal Identification Number

Street Address

City

State

ZIP Code

Daytime Telephone Number

Part I

Tax Return Information (See instructions on next page)

1. Total net income (loss) from U.S. S corporation/partnership return (IT-20S/IT-65 Line 1) ...........

1.

2. Total S corporation/partnership income, as adjusted (IT-20S/IT-65 Line 3) .................................

2.

3. IT-20S ONLY: Total income tax from Schedule B (IT-20S Line 12) ..............................................

3.

4. Total tax (IT-20S Line 15/IT-65 Line 7) .........................................................................................

4.

5. Subtotal (IT-20S Line 22/IT-65 Line 14) .......................................................................................

5.

6. Total amount due (IT-20S Line 27/IT-65 Line 18) .........................................................................

6.

7. Refund (IT-20S Line 27/IT-65 Line 19) .........................................................................................

7.

Part II

Declaration of Taxpayer

Under penalties of perjury, I declare that I am an officer of the S corporation/partnership listed above and the amounts in Part I agree with the

amounts on the corresponding lines of the electronic portion of the corporation’s/partnership’s 2015 Indiana income tax returns. To the best of my

knowledge and belief, this 2015 return is true, correct, and complete. I consent to my ERO sending my return, this declaration, and accompanying

schedule and statements to the DOR. I also consent to the DOR sending my ERO and/or transmitter an acknowledgement of receipt of transmission

and an indication of whether or not my return is accepted and, if rejected, the reason(s) for the rejection. If the processing of my return or refund

is delayed, I authorize the DOR to disclose to my ERO and/or transmitter the reason(s) for the delay of when the refund was sent.

In addition, by using a computer system and software to prepare and transmit my return electronically, I consent to the disclosure to the DOR of

all information pertaining to my use of the system and software and to the transmission of my tax return electronically.

Officer’s signature ► _____________________________ Title ____________________ Date __________________________

Part III

Declaration of ERO/Preparer/Transmitter

I confirm that I am submitting this return in accordance with the IRS and Indiana Department of Revenue electronic filing programs.

ERO’s EFIN _____________________________ PTIN (if preparer) ________________________ Phone _______________________

ERO’s Signature ► ________________________

I

N

D

I

A

N

A

ERO Must Retain This Form - See instructions. Do Not Submit this form to DOR unless requested to do so.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1