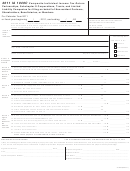

OREGON FORM 40F 2-D BARCODE RETURN - W/BC INDEXES

2011

Oregon Personal Income Tax Federal Worksheet

Last name

First name and initial

Social Security number (SSN)

–

–

Spouse’s last name if joint return

Spouse’s first name and initial if joint return

Spouse’s SSN, if joint return

–

–

PART 1: OREGON 1040

1

Single

4

Head of household

168

171

2

Married filing jointly

5

Qualifying widow(er)

169

172

3

Married filing separately

170

6c

Check if: Qualifying child for child tax credit

(4)

173

DRAFT

6c

Check if: Qualifying child for child tax credit

(4)

174

6c

Check if: Qualifying child for child tax credit

(4)

175

6c

Check if: Qualifying child for child tax credit

(4)

176

6d

Total number of exemptions

177

7 Wages, salaries, tips, etc. .............................................................

.. 7

178

FOR VENDOR USE ONLY

179

8a Taxable interest .............................................................................

8a

with Barcode Indexes

180

8b Tax-exempt interest ......................................................................

8b

181

9a Ordinary dividends ........................................................................

9a

182

9b Qualified dividends .......................................................................

9b

183

10 Taxable refunds, credits, or offsets of state and local income tax

10

11 Alimony received ......................................................................................................................................................................... 11

184

185

12 Business income or (loss) ........................................................................................................................................................... 12

186

13 Capital gain or (loss) ................................................................................................................................................................... 13

187

14 Other gains or (losses) ................................................................................................................................................................ 14

188

15b IRA distributions-taxable amount ............................................................................................................................................. 15b

189

16b Pensions and annuities-taxable amount ................................................................................................................................... 16b

17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. ...................................................................................... 17

190

191

18 Farm income or (loss) ................................................................................................................................................................. 18

192

19 Unemployment compensation .................................................................................................................................................... 19

193

20a Social Security benefits ............................................................................................................................................................ 20a

194

20b Social Security benefits taxable amount .................................................................................................................................. 20b

21 Other income .............................................................................................................................................................................. 21

195

22 Total income ................................................................................................................................................................................ 22

196

197

23 Educator expenses ..................................................................................................................................................................... 23

198

24 Certain business expenses of reservists, performing artists, and fee-basis government officials ............................................. 24

199

25 Health savings account deduction ............................................................................................................................................. 25

26 Moving expenses ........................................................................................................................................................................ 26

200

27 Deductible part of self-employment tax ..................................................................................................................................... 27

201

202

28 Self-employed SEP, SIMPLE, and qualified plans ...................................................................................................................... 28

203

29 Self-employed health insurance deduction ................................................................................................................................ 29

204

30 Penalty on early withdrawal of savings ....................................................................................................................................... 30

205

31a Alimony paid ............................................................................................................................................................................. 31a

206

32 IRA deduction ............................................................................................................................................................................. 32

207

33 Student loan interest deduction .................................................................................................................................................. 33

208

34 Tuition and fees ........................................................................................................................................................................... 34

209

35 Domestic production activities deduction .................................................................................................................................. 35

210

36 Total adjustments ....................................................................................................................................................................... 36

211

37 Adjusted gross income ............................................................................................................................................................... 37

39a Total boxes checked ........................................................................................................................................................... 39a

212

39b Check box if your spouse itemizes on a separate return or you were a dual-status alien ...................................................39b

213

40 Itemized deductions or your standard deduction ....................................................................................................................... 40

214

44a

Form(s) 8814

215

44b

Form 4972

216

44 Tax ............................................................................................................................................................................................... 44

217

45 Alternative minimum tax ............................................................................................................................................................. 45

218

219

47 Foreign tax credit ........................................................................................................................................................................ 47

220

48 Credit for child and dependent care expenses ........................................................................................................................... 48

221

49 Education credits ........................................................................................................................................................................ 49

➛

Continued on page 2

150-101-040-3 (Rev. 09-11) DRAFT 08-30-11

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17