Form 40 Draft - Idaho Individual Income Tax Return - 2012

ADVERTISEMENT

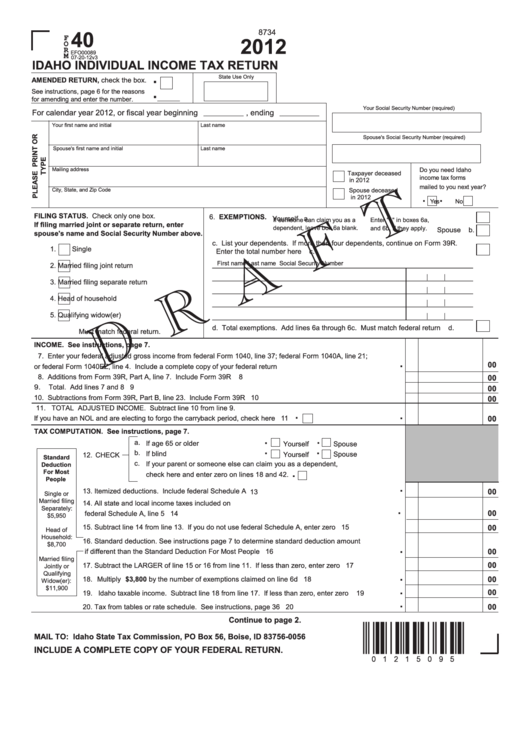

40

8734

F

2012

O

R

M

EFO00089

07-20-12v3

IDAHO INDIVIDUAL INCOME TAX RETURN

.

State Use Only

AMENDED RETURN, check the box.

.

See instructions, page 6 for the reasons

for amending and enter the number.

Your Social Security Number (required)

For calendar year 2012, or fiscal year beginning

, ending

Your first name and initial

Last name

Spouse's Social Security Number (required)

Spouse's first name and initial

Last name

Mailing address

Do you need Idaho

Taxpayer deceased

income tax forms

in 2012

mailed to you next year?

.

.

City, State, and Zip Code

Spouse deceased

in 2012

Yes

No

FILING STATUS. Check only one box.

6. EXEMPTIONS.

Yourself a.

I

f someone can claim you as a

Enter "1" in boxes 6a,

If filing married joint or separate return, enter

dependent, leave box 6a blank.

and 6b, if they apply.

Spouse

b.

spouse's name and Social Security Number above.

c. List your dependents. If more than four dependents, continue on Form 39R.

1.

Single

Enter the total number here ................................................................................ c.

First name

Last name

Social Security Number

___________________________________________________________________

2.

Married filing joint return

___________________________________________________________________

3.

Married filing separate return

___________________________________________________________________

4.

Head of household

___________________________________________________________________

5.

Qualifying widow(er)

___________________________________________________________________

d. Total exemptions. Add lines 6a through 6c. Must match federal return ............ d.

Must match federal return.

INCOME. See instructions, page 7.

.

7. Enter your federal adjusted gross income from federal Form 1040, line 37; federal Form 1040A, line 21;

or federal Form 1040EZ, line 4. Include a complete copy of your federal return ......................................................

7

00

8. Additions from Form 39R, Part A, line 7. Include Form 39R .....................................................................................

8

00

9. Total. Add lines 7 and 8 .............................................................................................................................................

9

00

10. Subtractions from Form 39R, Part B, line 23. Include Form 39R .............................................................................

10

00

.

11. TOTAL ADJUSTED INCOME. Subtract line 10 from line 9.

.

If you have an NOL and are electing to forgo the carryback period, check here

.......................................

11

00

TAX COMPUTATION. See instructions, page 7.

.

.

a.

If age 65 or older .............................

.

.

Spouse

Yourself

b.

If blind ..............................................

Spouse

Yourself

12.

CHECK

Standard

c.

If your parent or someone else can claim you as a dependent,

Deduction

.

For Most

check here and enter zero on lines 18 and 42.

People

.

13. Itemized deductions. Include federal Schedule A ..........................................................................

00

13

Single or

Married filing

.

14. All state and local income taxes included on

Separately:

00

federal Schedule A, line 5 ...............................................................................................................

14

$5,950

15. Subtract line 14 from line 13. If you do not use federal Schedule A, enter zero ............................

15

00

Head of

Household:

16. Standard deduction. See instructions page 7 to determine standard deduction amount

.

$8,700

00

if different than the Standard Deduction For Most People ..............................................................

16

Married filing

00

17. Subtract the LARGER of line 15 or 16 from line 11. If less than zero, enter zero ..........................

17

Jointly or

.

Qualifying

00

18. Multiply $3,800 by the number of exemptions claimed on line 6d ..................................................

18

Widow(er):

.

$11,900

00

19. Idaho taxable income. Subtract line 18 from line 17. If less than zero, enter zero

......................

19

.

00

20. Tax from tables or rate schedule. See instructions, page 36 .........................................................

20

Continue to page 2.

{"6S¦}

MAIL TO: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056

INCLUDE A COMPLETE COPY OF YOUR FEDERAL RETURN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2