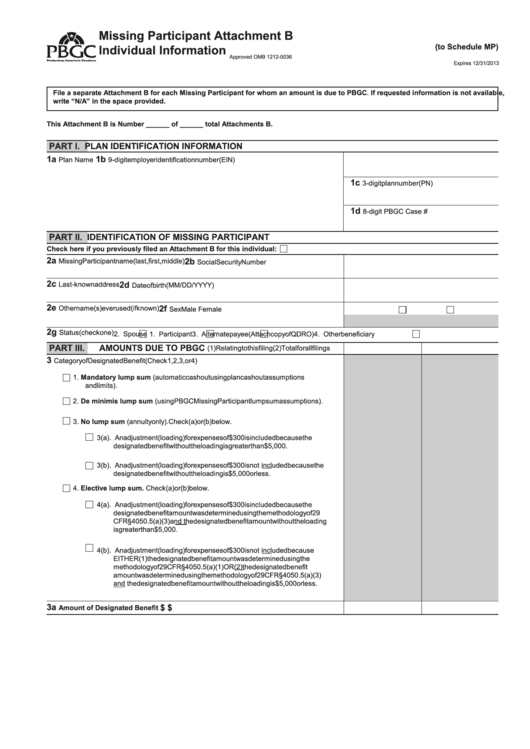

Missing Participant

Attachment B

(to Schedule MP)

Individual Information

Approved OMB 1212-0036

Expires 12/31/2013

File a separate Attachment B for each Missing Participant for whom an amount is due to PBGC. If requested information is not available,

write “N/A” in the space provided.

This Attachment B is Number ______ of ______ total Attachments B.

PART I.

PLAN IDENTIFICATION INFORMATION

1a

1b

9-digit employer identification number (EIN)

Plan Name

1c

3-digit plan number (PN)

1d

8-digit PBGC Case #

PART II.

IDENTIFICATION OF MISSING PARTICIPANT

Check here if you previously filed an Attachment B for this individual:

2a

2b

Missing Participant name (last, first, middle)

Social Security Number

2c

2d

Last-known address

Date of birth (MM/DD/YYYY)

2e

2f

Other name(s) ever used (if known)

Sex

Male

Female

2g

Status (check one)

1. Participant

2. Spouse

3. Alternate payee (Attach copy of QDRO)

4. Other beneficiary

PART III.

AMOUNTS DUE TO PBGC

(1) Relating to this filing (2) Total for all filings

3

Category of Designated Benefit (Check 1, 2, 3, or 4)

1. Mandatory lump sum (automatic cashout using plan cashout assumptions

and limits).

2. De minimis lump sum (using PBGC Missing Participant lump sum assumptions).

3. No lump sum (annuity only). Check (a) or (b) below.

3(a). An adjustment (loading) for expenses of $300 is included because the

designated benefit without the loading is greater than $5,000.

3(b). An adjustment (loading) for expenses of $300 is not included because the

designated benefit without the loading is $5,000 or less.

4. Elective lump sum. Check (a) or (b) below.

4(a). An adjustment (loading) for expenses of $300 is included because the

designated benefit amount was determined using the methodology of 29

CFR § 4050.5(a)(3) and the designated benefit amount without the loading

is greater than $5,000.

4(b). An adjustment (loading) for expenses of $300 is not included because

EITHER (1) the designated benefit amount was determined using the

methodology of 29 CFR § 4050.5(a)(1) OR (2) the designated benefit

amount was determined using the methodology of 29 CFR § 4050.5(a)(3)

and the designated benefit amount without the loading is $5,000 or less.

3a

$

$

Amount of Designated Benefit

1

1 2

2 3

3 4

4