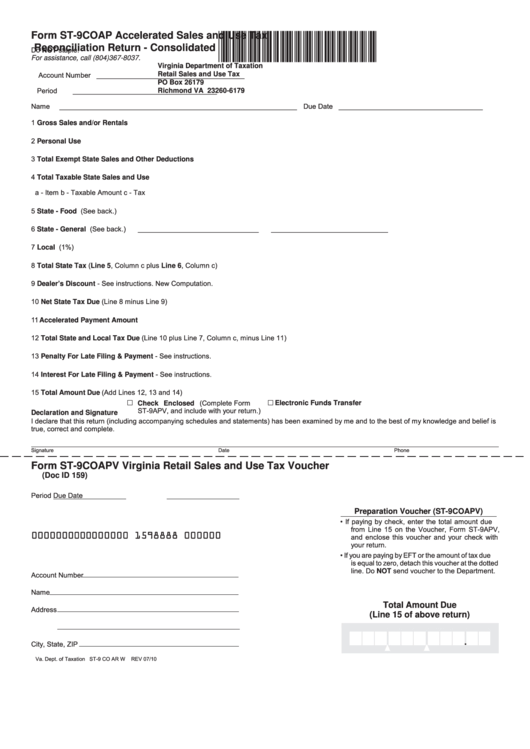

Form St-9coap - Accelerated Sales And Use Tax Reconciliation Return - Consolidated - 2010

ADVERTISEMENT

Form ST-9COAP

Accelerated Sales and Use Tax

Reconciliation Return - Consolidated

Do NOT staple.

For assistance, call (804)367-8037.

Virginia Department of Taxation

Retail Sales and Use Tax

Account Number ______________________________________

PO Box 26179

Period

_____________________________________

Richmond VA 23260-6179

Name _____________________________________________________________

Due Date _____________________________________

1 Gross Sales and/or Rentals ....................................................................................................................... 1 ______________________________

2 Personal Use ............................................................................................................................................... 2 ______________________________

3 Total Exempt State Sales and Other Deductions ..................................................................................... 3 ______________________________

4 Total Taxable State Sales and Use ............................................................................................................ 4 ______________________________

a - Item

b - Taxable Amount

c - Tax

5 State - Food (See back.) ...................................................... 5

_______________________________

______________________________

6 State - General (See back.) ................................................. 6

_______________________________

______________________________

7 Local (1%) ............................................................................ 7

_______________________________

______________________________

8 Total State Tax (Line 5, Column c plus Line 6, Column c) .......................................................................... 8 ______________________________

9 Dealer’s Discount - See instructions. New Computation. ........................................................................... 9 ______________________________

10 Net State Tax Due (Line 8 minus Line 9) ................................................................................................... 10 ______________________________

11 Accelerated Payment Amount ..................................................................................................................11 ______________________________

12 Total State and Local Tax Due (Line 10 plus Line 7, Column c, minus Line 11)....................................... 12 ______________________________

13 Penalty For Late Filing & Payment - See instructions. ........................................................................... 13 ______________________________

14 Interest For Late Filing & Payment - See instructions. ........................................................................... 14 ______________________________

15 Total Amount Due (Add Lines 12, 13 and 14) ........................................................................................... 15 ______________________________

Check Enclosed (Complete Form

Electronic Funds Transfer

ST-9APV, and include with your return.)

Declaration and Signature

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is

true, correct and complete.

Signature

Date

Phone Number

Form ST-9COAPV

Virginia Retail Sales and Use Tax Voucher

(Doc ID 159)

Period

Due Date

Preparation Voucher (ST-9COAPV)

•

If paying by check, enter the total amount due

from Line 15 on the Voucher, Form ST-9APV,

0000000000000000 1598888 000000

and enclose this voucher and your check with

your return.

•

If you are paying by EFT or the amount of tax due

is equal to zero, detach this voucher at the dotted

line. Do NOT send voucher to the Department.

Account Number

Name

Total Amount Due

Address

(Line 15 of above return)

.

City, State, ZIP

Va. Dept. of Taxation ST-9 CO AR W

REV 07/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1