Arizona Form 305 - Environmental Technology Facility Credit - 1999 Page 2

ADVERTISEMENT

Form 305 (1999) Page 2

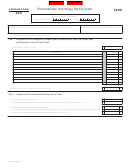

Part IV Available Credit Carryover

(a)

(b)

(c)

(d)

Carryover

Original credit

Amount

Available carryover

credit from

amount

previously used

Subtract column (c)

taxable year ending

from column (b)

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Total available

carryover

26

Part V Total Available Credit

27 Current year's credit. Individuals, corporations, or S corporations - enter amount from Part I, line 3.

S corporation shareholders - enter the amount from Part II, line 7.

Partners of a partnership - enter amount from Part III, line 10.

27

28 Available credit carryover - from Part IV, line 26, column (d)

28

29 Total available credit. Add line 27 and line 28 - enter here and on Form 300, Part I, line 3 or Form 301, Part I, line 3 ........................

29

Part VI Recapture of Environmental Technology Facility Credit

30 Date facility was placed in service

30

31 Date facility ceased to operate as an environmental manufacturing, producing or processing facility ..................................................

31

32 Enter total credit actually claimed for the total facility

32

33 Enter percent based on the year facility ceased to operate as an environmental manufacturing, producing or processing facility .

33

34 Total environmental technology facility credit recapture. Multiply line 32 by line 33. Enter result here

and on Form 300, Part II, line 22 or Form 301, Part II, line 26

34

ADOR 06-0052 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2