Form Il-1041 Draft - Fiduciary Income And Replacement Tax Return - 2007

ADVERTISEMENT

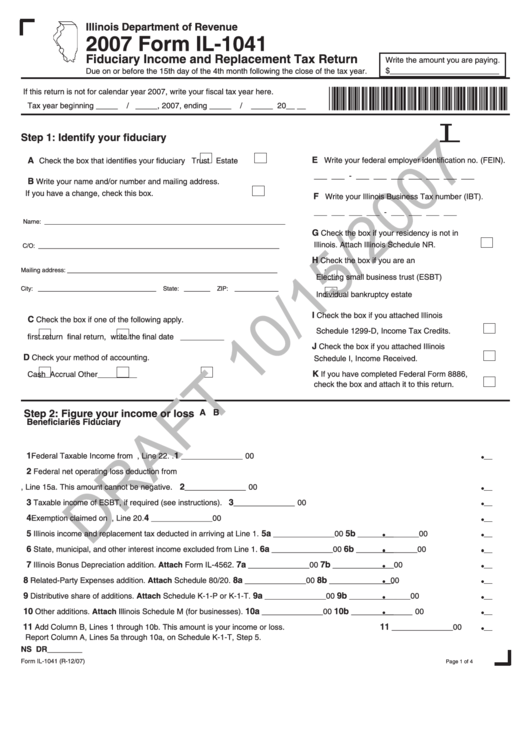

Illinois Department of Revenue

2007 Form IL-1041

Fiduciary Income and Replacement Tax Return

Write the amount you are paying.

$_________________________

Due on or before the 5th day of the 4th month following the close of the tax year.

*IL07636111332*

If this return is not for calendar year 2007, write your fiscal tax year here.

Tax year beginning _____

/ _____, 2007, ending _____

/

_____ 20__ __

Step 1: Identify your fiduciary

E

A

Write your federal employer identification no. (FEIN).

Check the box that identifies your fiduciary

Trust

Estate

___ ___ - ___ ___ ___ ___ ___ ___ ___

B

Write your name and/or number and mailing address.

If you have a change, check this box.

F

Write your Illinois Business Tax number (IBT).

___ ___ ___ ___ - ___ ___ ___ ___

_______________________________________________________

Name:

G

Check the box if your residency is not in

Illinois. Attach Illinois Schedule NR.

_______________________________________________________

C/O:

H

Check the box if you are an

________________________________________________

Mailing address:

Electing small business trust (ESBT)

___________________________

______

__________

City:

State:

ZIP:

Individual bankruptcy estate

I

Check the box if you attached Illinois

C

Check the box if one of the following apply.

Schedule 299-D, Income Tax Credits.

first return

final return, write the final date __________

J

Check the box if you attached Illinois

D

Check your method of accounting.

Schedule I, Income Received.

K

If you have completed Federal Form 8886,

Cash

Accrual

Other_________

check the box and attach it to this return.

Step 2: Figure your income or loss

A

B

Beneficiaries

Fiduciary

1

1

Federal Taxable Income from U.S. Form 04, Line 22.

.

______________ 00

2

Federal net operating loss deduction from

2

U.S. Form 04, Line 5a. This amount cannot be negative.

______________ 00

3

3

Taxable income of ESBT, if required (see instructions).

______________ 00

4

4

Exemption claimed on U.S. Form 04, Line 20.

______________ 00

5

5a

5b

Illinois income and replacement tax deducted in arriving at Line .

______________ 00

______________ 00

6

6a

6b

State, municipal, and other interest income excluded from Line .

______________ 00

______________ 00

7

7a

7b

Illinois Bonus Depreciation addition. Attach Form IL-4562.

______________ 00

______________ 00

8

8a

8b

Related-Party Expenses addition. Attach Schedule 80/20.

______________ 00

______________ 00

9

9a

9b

Distributive share of additions. Attach Schedule K--P or K--T.

______________ 00

______________ 00

10

10a

10b

Other additions. Attach Illinois Schedule M (for businesses).

______________ 00

______________ 00

11

11

Add Column B, Lines through 0b. This amount is your income or loss.

______________ 00

Report Column A, Lines 5a through 0a, on Schedule K--T, Step 5.

NS DR________

Form IL-04 (R-2/07)

Page of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4