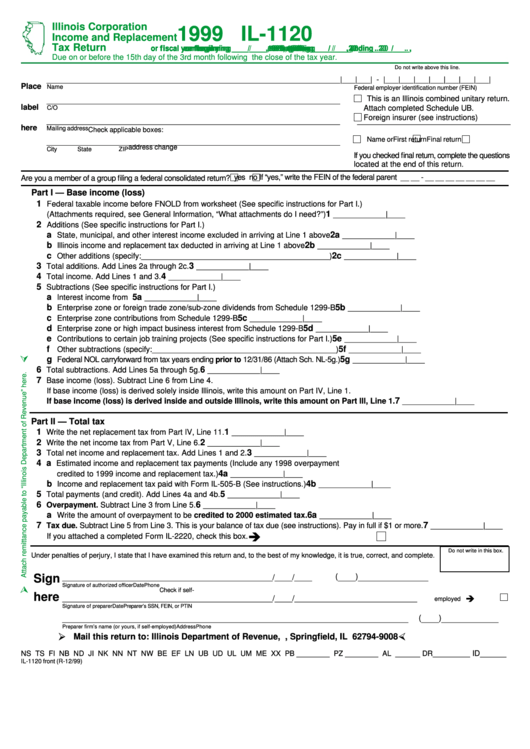

Form Il-1120 - Illinois Corporation Income And Replacement Tax Return - Il Department Of Revenue - 1999

ADVERTISEMENT

Illinois Corporation

1999 IL-1120

Income and Replacement

Tax Return

or fiscal y

or fiscal y

or fiscal year beginning ____/____,

ear beginning ____/____,

ear beginning ____/____, 1999,

ear beginning ____/____,

1999,

1999,

1999, ending ____/____,

ending ____/____,

ending ____/____,

ending ____/____, 20 ____.

20 ____.

20 ____.

20 ____.

or fiscal y

or fiscal y

ear beginning ____/____,

1999,

ending ____/____,

20 ____.

Due on or before the 15th day of the 3rd month following the close of the tax year.

Do not write above this line.

___________________________________________________________________

|___|___| - |___|___|___|___|___|___|___|

Place

Name

Federal employer identification number (FEIN)

This is an Illinois combined unitary return.

___________________________________________________________________

label

Attach completed Schedule UB.

C/O

Foreign insurer (see instructions)

___________________________________________________________________

___________________________________

here

Mailing address

Check applicable boxes:

Name or

First return

Final return

___________________________________________________________________

address change

City

State

ZIP

If you checked final return, complete the questions

located at the end of this return.

yes

no If “yes,” write the FEIN of the federal parent __ __ - __ __ __ __ __ __ __

Are you a member of a group filing a federal consolidated return?

Part I — Base income (loss)

1

Federal taxable income before FNOLD from worksheet (See specific instructions for Part I.)

1

(Attachments required, see General Information, “What attachments do I need?”)

____________|____

2

Additions (See specific instructions for Part I.)

a

2a

State, municipal, and other interest income excluded in arriving at Line 1 above

____________|____

b

2b

Illinois income and replacement tax deducted in arriving at Line 1 above

____________|____

c

2c

Other additions (specify:___________________________________________)

____________|____

3

3

Total additions. Add Lines 2a through 2c.

____________|____

4

4

Total income. Add Lines 1 and 3.

____________|____

5

Subtractions (See specific instructions for Part I.)

a

5a

Interest income from U.S. Treasury and federal agency obligations

____________|____

b

5b

Enterprise zone or foreign trade zone/sub-zone dividends from Schedule 1299-B

____________|____

c

5c

Enterprise zone contributions from Schedule 1299-B

____________|____

d

5d

Enterprise zone or high impact business interest from Schedule 1299-B

____________|____

e

5e

Contributions to certain job training projects (See specific instructions for Part I.)

____________|____

f

5f

Other subtractions (specify:__________________________________________)

____________|____

g

5g

Federal NOL carryforward from tax years ending prior to 12/31/86 (Attach Sch. NL-5g.)

____________|____

6

6

Total subtractions. Add Lines 5a through 5g.

____________|____

7

Base income (loss). Subtract Line 6 from Line 4.

If base income (loss) is derived solely inside Illinois, write this amount on Part IV, Line 1.

7

If base income (loss) is derived inside and outside Illinois, write this amount on Part III, Line 1.

____________|____

Part II — Total tax

1

1

Write the net replacement tax from Part IV, Line 11.

____________|____

2

2

Write the net income tax from Part V, Line 6.

____________|____

3

3

Total net income and replacement tax. Add Lines 1 and 2.

____________|____

4 a

Estimated income and replacement tax payments (Include any 1998 overpayment

4a

credited to 1999 income and replacement tax.)

____________|____

b

4b

Income and replacement tax paid with Form IL-505-B (See instructions.)

____________|____

5

5

Total payments (and credit). Add Lines 4a and 4b.

____________|____

6

6

Overpayment. Subtract Line 3 from Line 5.

____________|____

a

6a

Write the amount of overpayment to be credited to 2000 estimated tax.

____________|____

7

7

Tax due. Subtract Line 5 from Line 3. This is your balance of tax due (see instructions). Pay in full if $1 or more.

____________|____

Î

If you attached a completed Form IL-2220, check this box.

Do not write in this box.

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

( ____ ) ________________

Sign

________________________________________________/____/____

Signature of authorized officer

Date

Phone

Check if self-

here

Î

________________________________________________/____/____

________________________

employed

Signature of preparer

Date

Preparer’s SSN, FEIN, or PTIN

( ____ ) _____________

_______________________________

________________________________________________

Preparer firm’s name (or yours, if self-employed)

Address

Phone

¾

½

Mail this return to: Illinois Department of Revenue, P.O. Box 19008, Springfield, IL 62794-9008

ID______

NS TS FI NB ND JI NK NN NT NW BE EF LN UB UD UL UM ME XX PB ________ PZ ________ AL ______ DR_________

IL-1120 front (R-12/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2