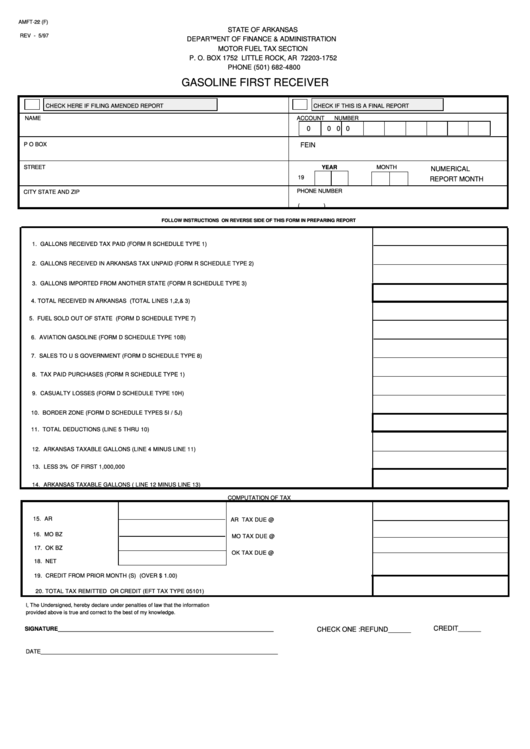

AMFT-22 (F)

STATE OF ARKANSAS

REV - 5/97

DEPARTMENT OF FINANCE & ADMINISTRATION

MOTOR FUEL TAX SECTION

P. O. BOX 1752 LITTLE ROCK, AR 72203-1752

PHONE (501) 682-4800

GASOLINE FIRST RECEIVER

CHECK HERE IF FILING AMENDED REPORT

CHECK IF THIS IS A FINAL REPORT

NAME

ACCOUNT

NUMBER

0

0

0

0

P O BOX

FEIN

STREET

YEAR

MONTH

NUMERICAL

19

REPORT MONTH

PHONE NUMBER

CITY STATE AND ZIP

(

)

FOLLOW INSTRUCTIONS ON REVERSE SIDE OF THIS FORM IN PREPARING REPORT

1. GALLONS RECEIVED TAX PAID (FORM R SCHEDULE TYPE 1).............................................................

2. GALLONS RECEIVED IN ARKANSAS TAX UNPAID (FORM R SCHEDULE TYPE 2).....................................

3. GALLONS IMPORTED FROM ANOTHER STATE (FORM R SCHEDULE TYPE 3)........................................

4. TOTAL RECEIVED IN ARKANSAS (TOTAL LINES 1,2,& 3)....................................................................

5. FUEL SOLD OUT OF STATE (FORM D SCHEDULE TYPE 7)..................................................................

6. AVIATION GASOLINE (FORM D SCHEDULE TYPE 10B)......................................................................

7. SALES TO U S GOVERNMENT (FORM D SCHEDULE TYPE 8)................................................................

8. TAX PAID PURCHASES (FORM R SCHEDULE TYPE 1).........................................................................

9. CASUALTY LOSSES (FORM D SCHEDULE TYPE 10H)...........................................................................

10. BORDER ZONE (FORM D SCHEDULE TYPES 5I / 5J).........................................................................

11. TOTAL DEDUCTIONS (LINE 5 THRU 10).........................................................................................

12. ARKANSAS TAXABLE GALLONS (LINE 4 MINUS LINE 11)..................................................................

13. LESS 3% OF FIRST 1,000,000 GALLONS.......................................................................................

14. ARKANSAS TAXABLE GALLONS ( LINE 12 MINUS LINE 13)..............................................................

COMPUTATION OF TAX

15. AR GALLONS............

AR TAX DUE @ .185.................................

16. MO BZ GALLONS......

MO TAX DUE @ .18.................................

17. OK BZ GALLONS......

OK TAX DUE @ .17.................................

18. NET GALLONS.........

19. CREDIT FROM PRIOR MONTH (S) (OVER $ 1.00).........................................................................

20. TOTAL TAX REMITTED OR CREDIT (EFT TAX TYPE 05101)............................................................

I, The Undersigned, hereby declare under penalties of law that the information

provided above is true and correct to the best of my knowledge.

CREDIT______

SIGNATURE____________________________________________________________________

CHECK ONE :

REFUND______

DATE___________________________________________________________________________

1

1