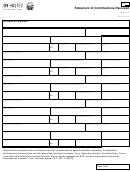

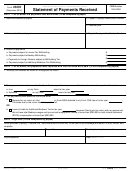

Page

Statement of Loans Received

Form 31-C

R.C. 3517.10

Full Name of Committee

From Whom Received

Prior Amount

Amt. Incurred this Period

Outstanding Balance

Street Address

City

State

Zip Code

Payments This Period

Loans Received This Period

Date of Loan (MM/DD/YYYY) Amount

Amount

Date Loan was Originally Incurred (MM/DD/YYYY)

Date of Payment (MM/DD/YYYY)

Registration Number, if PAC

Amount

Amount

Date of Loan (MM/DD/YYYY)

Date of Payment (MM/DD/YYYY)

Employer/Occupation/Labor Organization*

Amount

Amount

Date of Loan (MM/DD/YYYY)

Date of Payment (MM/DD/YYYY)

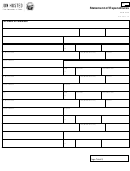

From Whom Received

Prior Amount

Amt. Incurred this Period

Outstanding Balance

Street Address

City

State

Zip Code

Payments This Period

Loans Received This Period

Date of Loan (MM/DD/YYYY) Amount

Amount

Date Loan was Originally Incurred (MM/DD/YYYY)

Date of Payment (MM/DD/YYYY)

Registration Number, if PAC

Amount

Amount

Date of Loan (MM/DD/YYYY)

Date of Payment (MM/DD/YYYY)

Employer/Occupation/Labor Organization*

Amount

Amount

Date of Loan (MM/DD/YYYY)

Date of Payment (MM/DD/YYYY)

* Required for contributions from individuals over $100 to statewide and general assembly candidates. If contributor is self-employed, the occupation and the

name of the individual’s business, if any, rather than employer should be listed. If two or more employees contribute via payroll deduction and exceed the

aggregate of $100, the labor organization of which the employees are members, if any, must also appear. [R.C. 3517.10(B)(4)]

If a loan is forgiven, write “Forgiven” in the “Outstanding Balance” space. Transfer total of all loans received this period to the Statement of Other Income

(Form No. 31-A-2). Transfer total of all payments made in this period to the Statement of Expenditures (Form No. 31-B). Transfer Outstanding Balance to the

Cover page (Form No. 30-A).

Total Prior Amount $

Total Received This Period $

(also record on Form 31-A-2)

Total Payments Received this Period $

(also record on Form 31-B)

Total Outstanding Balance $

(also record on Form 30-A)

1

1 2

2