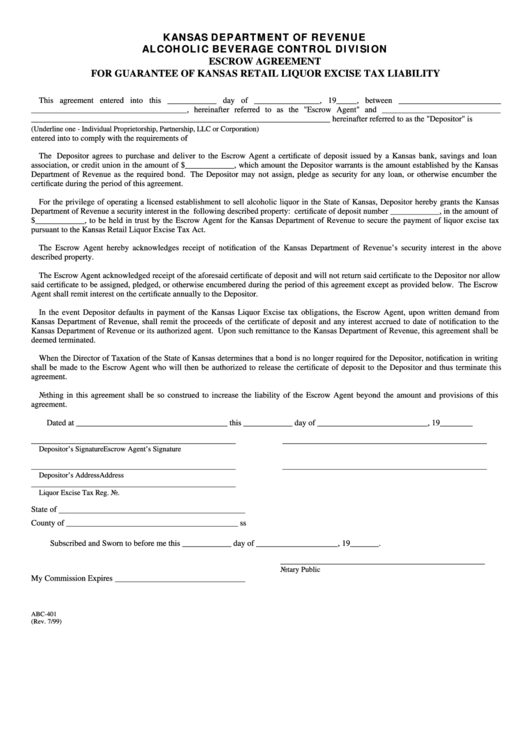

Form Abc-401 - Escrow Agreement For Guarantee Of Kansas Retail Liquor Excise Tax Liability

ADVERTISEMENT

KANSAS DEPARTMENT OF REVENUE

ALCOHOLIC BEVERAGE CONTROL DIVISION

ESCROW AGREEMENT

FOR GUARANTEE OF KANSAS RETAIL LIQUOR EXCISE TAX LIABILITY

This agreement entered into this ____________ day of ________________, 19_____, between _________________________

______________________________________, hereinafter referred to as the "Escrow Agent" and _____________________________

_________________________________________________________________________ hereinafter referred to as the "Depositor" is

(Underline one - Individual Proprietorship, Partnership, LLC or Corporation)

entered into to comply with the requirements of K.S.A. 79-41a03 as amended.

The Depositor agrees to purchase and deliver to the Escrow Agent a certificate of deposit issued by a Kansas bank, savings and loan

association, or credit union in the amount of $____________, which amount the Depositor warrants is the amount established by the Kansas

Department of Revenue as the required bond. The Depositor may not assign, pledge as security for any loan, or otherwise encumber the

certificate during the period of this agreement.

For the privilege of operating a licensed establishment to sell alcoholic liquor in the State of Kansas, Depositor hereby grants the Kansas

Department of Revenue a security interest in the following described property: certificate of deposit number ____________, in the amount of

$____________, to be held in trust by the Escrow Agent for the Kansas Department of Revenue to secure the payment of liquor excise tax

pursuant to the Kansas Retail Liquor Excise Tax Act.

The Escrow Agent hereby acknowledges receipt of notification of the Kansas Department of Revenue’s security interest in the above

described property.

The Escrow Agent acknowledged receipt of the aforesaid certificate of deposit and will not return said certificate to the Depositor nor allow

said certificate to be assigned, pledged, or otherwise encumbered during the period of this agreement except as provided below. The Escrow

Agent shall remit interest on the certificate annually to the Depositor.

In the event Depositor defaults in payment of the Kansas Liquor Excise tax obligations, the Escrow Agent, upon written demand from

Kansas Department of Revenue, shall remit the proceeds of the certificate of deposit and any interest accrued to date of notification to the

Kansas Department of Revenue or its authorized agent. Upon such remittance to the Kansas Department of Revenue, this agreement shall be

deemed terminated.

When the Director of Taxation of the State of Kansas determines that a bond is no longer required for the Depositor, notification in writing

shall be made to the Escrow Agent who will then be authorized to release the certificate of deposit to the Depositor and thus terminate this

agreement.

Nothing in this agreement shall be so construed to increase the liability of the Escrow Agent beyond the amount and provisions of this

agreement.

Dated at _____________________________________ this ____________ day of ___________________________, 19________

__________________________________________________

__________________________________________________

Depositor’s Signature

Escrow Agent’s Signature

__________________________________________________

__________________________________________________

Depositor’s Address

Address

__________________________________________________

Liquor Excise Tax Reg. No.

State of

County of __________________________________________ ss

Subscribed and Sworn to before me this ____________ day of ____________________, 19_______.

__________________________________________________

Notary Public

My Commission Expires

ABC-401

(Rev. 7/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1