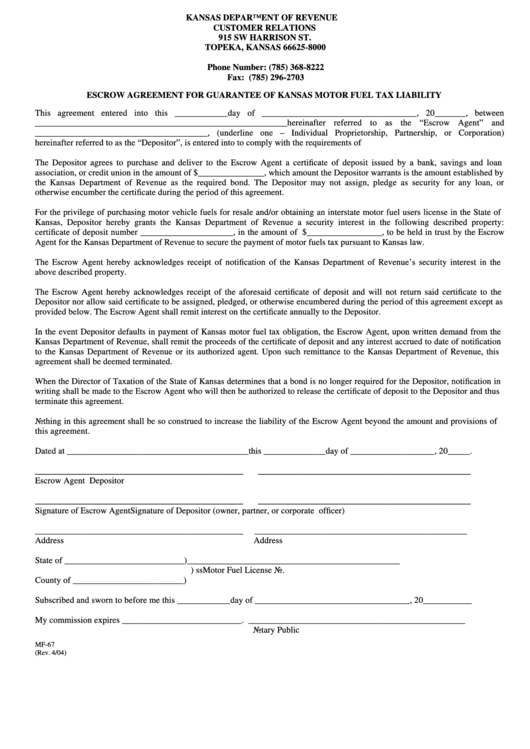

Form Mf-67 - Escrow Agreement For Guarantee Of Kansas Motor Fuel Tax Liability

ADVERTISEMENT

KANSAS DEPARTMENT OF REVENUE

CUSTOMER RELATIONS

915 SW HARRISON ST.

TOPEKA, KANSAS 66625-8000

Phone Number: (785) 368-8222

Fax: (785) 296-2703

ESCROW AGREEMENT FOR GUARANTEE OF KANSAS MOTOR FUEL TAX LIABILITY

This agreement entered into this ____________day of ___________________________________, 20_______, between

_________________________________________________________hereinafter referred to as the “Escrow Agent” and

_______________________________________, (underline one – Individual Proprietorship, Partnership, or Corporation)

hereinafter referred to as the “Depositor”, is entered into to comply with the requirements of K.S.A. _________________.

The Depositor agrees to purchase and deliver to the Escrow Agent a certificate of deposit issued by a bank, savings and loan

association, or credit union in the amount of $_______________, which amount the Depositor warrants is the amount established by

the Kansas Department of Revenue as the required bond. The Depositor may not assign, pledge as security for any loan, or

otherwise encumber the certificate during the period of this agreement.

For the privilege of purchasing motor vehicle fuels for resale and/or obtaining an interstate motor fuel users license in the State of

Kansas, Depositor hereby grants the Kansas Department of Revenue a security interest in the following described property:

certificate of deposit number _____________________, in the amount of $_________________, to be held in trust by the Escrow

Agent for the Kansas Department of Revenue to secure the payment of motor fuels tax pursuant to Kansas law.

The Escrow Agent hereby acknowledges receipt of notification of the Kansas Department of Revenue’s security interest in the

above described property.

The Escrow Agent hereby acknowledges receipt of the aforesaid certificate of deposit and will not return said certificate to the

Depositor nor allow said certificate to be assigned, pledged, or otherwise encumbered during the period of this agreement except as

provided below. The Escrow Agent shall remit interest on the certificate annually to the Depositor.

In the event Depositor defaults in payment of Kansas motor fuel tax obligation, the Escrow Agent, upon written demand from the

Kansas Department of Revenue, shall remit the proceeds of the certificate of deposit and any interest accrued to date of notification

to the Kansas Department of Revenue or its authorized agent. Upon such remittance to the Kansas Department of Revenue, this

agreement shall be deemed terminated.

When the Director of Taxation of the State of Kansas determines that a bond is no longer required for the Depositor, notification in

writing shall be made to the Escrow Agent who will then be authorized to release the certificate of deposit to the Depositor and thus

terminate this agreement.

Nothing in this agreement shall be so construed to increase the liability of the Escrow Agent beyond the amount and provisions of

this agreement.

Dated at _________________________________________this ______________day of ___________________, 20_____.

_______________________________________________

________________________________________________

Escrow Agent

Depositor

_______________________________________________

________________________________________________

Signature of Escrow Agent

Signature of Depositor (owner, partner, or corporate officer)

_______________________________________________

________________________________________________

Address

Address

State of ___________________________

)

________________________________________________

)

ss

Motor Fuel License No.

County of _________________________

)

Subscribed and sworn to before me this ____________day of ___________________________________, 20___________

My commission expires ___________________________.

_________________________________________________

Notary Public

MF-67

(Rev. 4/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1