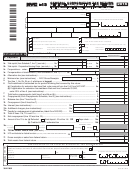

Form Nyc 4s - General Corporation Tax Return - 1999 Page 2

ADVERTISEMENT

Form NYC-4S - 1999

NAME _____________________________________________________________

EIN __________________________

Page 2

Computation of NYC Taxable Net Income

S C H E D U L E

B

Federal taxable income before net operating loss deduction and special deductions (see instructions) .. 1.

1.

2.

Interest on federal, state, municipal and other obligations not included in line 1................................. 2.

3a.

NYS Franchise Tax and other income taxes, including MTA surcharge, deducted on federal return (see instr.) ...... 3a.

3b. NYC General Corporation Tax deducted on federal return (see instructions) ...................................... 3b.

4.

ACRS depreciation and/or adjustment (attach Form NYC-399) (see instructions) .............................. 4.

5.

Total (sum of lines 1 through 4) ............................................................................................................ 5.

6a. New York City net operating loss deduction (see instructions) .......... 6a.

6b. Depreciation and/or adjustment calculated under pre-ACRS rules

S CORPORATIONS

see instructions

(attach Form NYC-399) (see instructions).......................................... 6b.

for line 1

6c.

NYC and NYS tax refunds included in Schedule B,

line 1 (see instructions)....................................................................... 6c.

7.

Total (sum of lines 6a through 6c)......................................................................................................... 7.

8.

Taxable net income (line 5 less line 7) (enter on page 1, Schedule A, line 1) (see instructions) ......... 8.

Total Capital

S C H E D U L E

C

Basis used to determine average value in column C. Check one. (Attach detailed schedule)

- Annually

- Semi-annually

- Quarterly

COLUMN A

COLUMN B

COLUMN C

Beginning of Year

End of Year

Average Value

- Monthly

- Weekly

- Daily

1.

Total assets from federal return .............................................1.

2.

Real property and marketable securities included in line 1 ..........2.

3.

Subtract line 2 from line 1 ...............................................................3.

4.

Real property and marketable securities at fair market value ......4.

5.

Adjusted total assets (add lines 3 and 4) .......................................5.

6.

Total liabilities (see instructions) ...................................................... 6.

7.

Total capital (column C, line 5 less column C, line 6) (enter on page 1, Schedule A, line 2a or 2b) ..........................7.

Of ficers (appointed or elected) and Cer tain Stockholders

S C H E D U L E

D

Include all officers, whether or not receiving any compensation, and every stockholder owning in excess of 5% of taxpayer's issued capital stock who received any compensation, including commissions.

Salary & All Other Compensation

Name and Address - Give actual residence (Attach rider if necessary)

Social Security Number

Official Title

Received from Corporation

(If none, write "none")

1.

Total, including any amount on rider (enter on page 1, Schedule A, line 3a)

1.

S C H E D U L E E

The following infor mation must be entered for this retur n to be complete.

1.

New York City principal business activity

2.

Does the corporation have an interest in real property located in New York City? ...................................................................................................YES

NO

3.

If "YES": (a) Attach a schedule of such property, including street address, borough, block and lot number.

(b) Was a controlling economic interest in this corporation (i.e., 50% or more of stock ownership) transferred during the tax year?....YES

NO

4.

Does the corporation have one or more qualified subchapter s subsidiaries?..........................................................................................................YES

NO

(a) If "YES": Are all items of income, gain, loss, deduction and capital of each QSSS included in this report?.....................................................YES

NO

i) If "NO”, attach a schedule showing the name, address and EIN, if any, of each QSSS NOT included in this report and indicate whether

the QSSS filed or was required to file a City business income tax return.

,

8

PREPAYMENTS CLAIMED ON SCHEDULE A

LINE

DATE

AMOUNT

TWELVE DIGIT TRANSACTION ID CODE

A. Mandatory first installment paid with preceding year's tax ....

Payment with declaration, Form NYC-400 (1) ......................

B. Payment of estimated tax, Form NYC-B-100 (2) ..................

Form NYC-B-100 (3) .............................................................

C. Payment with extension, Form NYC-6 or NYC-6F.................

D. Overpayment credited from preceding year ..........................

E. TOTAL of A, B, C and D (enter on Schedule A, line 8) .........

MAILING

RETURNS WITH REMITTANCES

RETURNS CLAIMING REFUNDS

ALL OTHER RETURNS

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

INSTRUCTIONS

BOX 3900 CHURCH STREET STATION

BOX 1117 WALL STREET STATION

BOX 1130 WALL STREET STATION

NEW YORK, NY 10008-3900

NEW YORK, NY 10268-1117

NEW YORK, NY 10268-1130

The due date for the calendar year 1999 return is on or before March 15, 2000. For fiscal years beginning in 1999, File within 2 1/2 months after the close of fiscal year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2