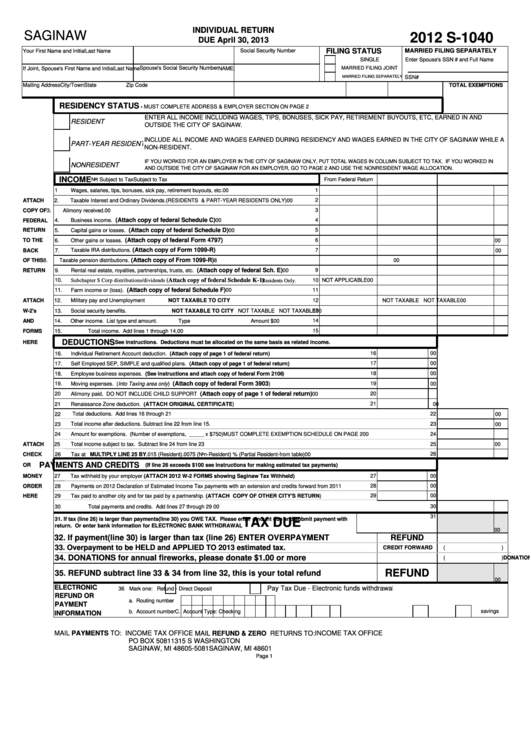

Form S-1040 - Individual Return - 2012

ADVERTISEMENT

INDIVIDUAL RETURN

SAGINAW

2012 S-1040

DUE April 30, 2013

FILING STATUS

MARRIED FILING SEPARATELY

Your First Name and Initial

Last Name

Social Security Number

SINGLE

Enter Spouse's SSN # and Full Name

Spouse's Social Security Number

If Joint, Spouse's First Name and Initial

Last Name

MARRIED FILING JOINT

NAME:

MARRIED FILING SEPARATELY

SSN#

Mailing Address

City/Town

State

Zip Code

TOTAL EXEMPTIONS

RESIDENCY STATUS

- MUST COMPLETE ADDRESS & EMPLOYER SECTION ON PAGE 2

ENTER ALL INCOME INCLUDING WAGES, TIPS, BONUSES, SICK PAY, RETIREMENT BUYOUTS, ETC, EARNED IN AND

RESIDENT

OUTSIDE THE CITY OF SAGINAW.

INCLUDE ALL INCOME AND WAGES EARNED DURING RESIDENCY AND WAGES EARNED IN THE CITY OF SAGINAW WHILE A

PART-YEAR RESIDENT

NON-RESIDENT.

IF YOU WORKED FOR AN EMPLOYER IN THE CITY OF SAGINAW ONLY, PUT TOTAL WAGES IN COLUMN SUBJECT TO TAX. IF YOU WORKED IN

NONRESIDENT

AND OUTSIDE THE CITY OF SAGINAW FOR AN EMPLOYER, GO TO PAGE 2 AND USE THE NONRESIDENT WAGE ALLOCATION.

INCOME

From Federal Return

Not Subject to Tax

Subject to Tax

1

Wages, salaries, tips, bonuses, sick pay, retirement buyouts, etc.

1

00

ATTACH

2.

Taxable Interest and Ordinary Dividends.

(RESIDENTS & PART-YEAR RESIDENTS ONLY)

2

00

COPY OF

3.

Alimony received.

3

00

(Attach copy of federal Schedule C)

4

FEDERAL

4.

Business income.

00

RETURN

(Attach copy of federal Schedule D)

5

5.

Capital gains or losses.

00

TO THE

(Attach copy of federal Form 4797)

6

6.

Other gains or losses.

00

(Attach copy of Form 1099-R)

7

BACK

7.

Taxable IRA distributions.

00

(Attach copy of From 1099-R)

OF THIS

8.

Taxable pension distributions.

8

00

(Attach copy of federal Sch. E)

9

RETURN

9.

Rental real estate, royalties, partnerships, trusts, etc.

00

10

10.

(Attach copy of federal Schedule K-1)

NOT APPLICABLE

00

Subchapter S Corp distributions/dividends

Residents Only.

(Attach copy of federal Schedule F)

11.

Farm income or (loss).

11

00

Military pay and Unemployment

NOT TAXABLE TO CITY

12

ATTACH

12.

NOT TAXABLE

NOT TAXABLE

00

W-2's

13.

Social security benefits.

NOT TAXABLE TO CITY

13

NOT TAXABLE

NOT TAXABLE

00

14

AND

14.

Other income. List type and amount.

Type

Amount $

00

15

FORMS

15.

Total income. Add lines 1 through 14.

00

DEDUCTIONS

HERE

See instructions. Deductions must be allocated on the same basis as related income.

16.

Individual Retirement Account deduction. (Attach copy of page 1 of federal return)

16

00

17.

Self Employed SEP, SIMPLE and qualified plans. (Attach copy of page 1 of federal return)

17

00

18.

Employee business expenses. (See instructions and attach copy of federal Form 2106 )

18

00

(Attach copy of federal Form 3903

19

19.

Moving expenses. (Into Taxing area only )

)

00

(Attach copy of page 1 of federal return)

20

Alimony paid. DO NOT INCLUDE CHILD SUPPORT

20

00

21

Renaissance Zone deduction. (ATTACH ORIGINAL CERTIFICATE)

21

00

Total deductions. Add lines 16 through 21

22

22

00

Total income after deductions. Subtract line 22 from line 15.

23

23

00

24

Amount for exemptions. (Number of exemptions, _____ x $750)

MUST COMPLETE EXEMPTION SCHEDULE ON PAGE 2

24

00

ATTACH

25

Total income subject to tax. Subtract line 24 from line 23

25

00

CHECK

26

Tax at

MULTIPLY LINE 25 BY

.015 (Resident)

.0075 (Non-Resident)

% (Partial Resident-from table)

26

00

PAYMENTS AND CREDITS

OR

(If line 26 exceeds $100 see instructions for making estimated tax payments)

MONEY

27

Tax withheld by your employer (ATTACH 2012 W-2 FORMS showing Saginaw Tax Withheld)

27

00

ORDER

28

Payments on 2012 Declaration of Estimated Income Tax payments with an extension and credits forward from 2011

28

00

29

00

HERE

29

Tax paid to another city and for tax paid by a partnership. (ATTACH COPY OF OTHER CITY'S RETURN)

30

Total payments and credits. Add lines 27 through 29

30

00

31

31. If tax (line 26) is larger than payments(line 30) you OWE TAX. Please enter amount due and submit payment with

TAX DUE

return. Or enter bank information for ELECTRONIC BANK WITHDRAWAL

00

32. If payment(line 30) is larger than tax (line 26) ENTER OVERPAYMENT

REFUND

33. Overpayment to be HELD and APPLIED TO 2013 estimated tax.

CREDIT FORWARD

(

)

34. DONATIONS for annual fireworks, please donate $1.00 or more

DONATION

(

)

REFUND

35. REFUND subtract line 33 & 34 from line 32, this is your total refund

00

ELECTRONIC

Pay Tax Due - Electronic funds withdrawal

36 Mark one:

Refund - Direct Deposit

REFUND OR

a. Routing number

PAYMENT

savings

b. Account number

C. Account Type:

Checking

INFORMATION

MAIL PAYMENTS TO: INCOME TAX OFFICE

MAIL REFUND & ZERO RETURNS TO: INCOME TAX OFFICE

PO BOX 5081

1315 S WASHINGTON

SAGINAW, MI 48605-5081

SAGINAW, MI 48601

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2