Form Bc-1040 - Individual Return - Battle Creek - 2012

ADVERTISEMENT

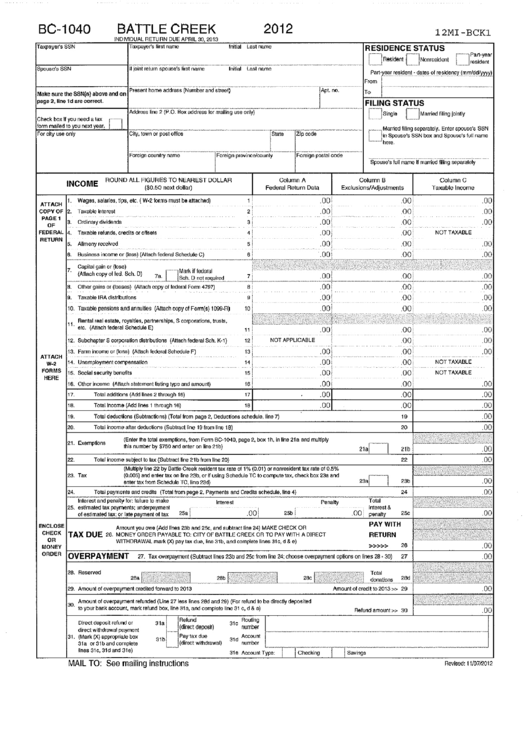

BC-1040

BATTLE CREEK

INDIVIDUAL RETURN DUE APRIL 30, 2013

2012

12MI-BCKI

Taxpayer's SSN

Spouse's SSN

Taxpayer's first name

!I joint return spouse's first name

Initial

last

name

Initial

Last name

RESIDENCE STATUS

[ ] Residen1

[--~'INonresident

....---]

~~7~~~~r

Part-X~8!_~~~i~,~~!,~ __ ,~!J:tf:}~():!,~f:},~i,C!~r1c:y..('!!~C!~Y,m'!

From

00

Column C

Taxable Income

.00

00

00

NOT TAXABLE

.00

.00

.00

.00

.00

00

.00

.00

.00

NOT TAXABLE

NOT TAXABLE

.00

.00

.00

.00

.00

.00

.00

.00

.00

00

2tb

'0

19

.00

Spouse's full name if married filing separately

FILING STATUS

[' ']single

[~]Married

filing jointly

[

,__jMarried filing separateiy. Enter spouse's SSN

in Spouse's SSN box and Spouse's full name

---- here.

To

2ta

Total

interest

&

_00

penalty

'50

PAY WITH

RETURN

»»>

Column

B

Exclusions/Adjustments

Amount of credit to 2013» 29

Foreign postal code

Zip code

Column A

Federal Return Data

2

3

4

8

9

10

11

12

NOT APPLICABLE

13

14

15

16

17

.00

18

.00

-

Jstat.

rocei90

pmv,",.loo"",y

-,"',---

",',----'

..

'"",---"--_

..

,,

Foreign country name

(Enter the total exemptions, from Form BC-1040, page 2, box th, in line 21a and multiply

this number by $750 and enter on line 21b)

ROUND ALL FIGURES TO NEAREST DOLLAR

($0.50

next dollar)

Total deductions (Subtractions) (Total from page 2, Deductions schedule, line 7)

T01al income after deductions (Subtract line 19 from line 18)

Total income (Add lines 1 through 16)

Total additions (Add lines 2 through 16)

'8a

t8

29. Amount of overpayment credited forward to 2013

12. Subchapter S corporation distributions (Allach federal Sch. K-1)

13. Farm income or (loss) (Attach federal Schedule F)

14. Unemployment compensatlon

15. Social security benefits

16. Other income (Attach statement listing type and amount)

11. Rental real estate, royalties, partnerships, S corporations, trusts,

etc. (Allach federal Schedule E)

(MUltiply line 22 by Battle Creek resident tax rate of 1% (0.01) or nonresident1ax ra1e of 0.5%

23. Tax

(0.005) and enter tax on line 23b, or if using Schedule TC to compute tax, check box 23a and

enter tax from Schedule TC, line 23d)

23a

23b

Amount you owe (Add lines 23b and 25c, and subtract line 24) MAKE CHECK OR

TAX DUE

26. MONEY ORDER PAYABLE TO: CITY OF BATTLE CREEK OR TO PAY WITH A DIRECT

WITHDRAWAL mark (X) pay tax due, line 31b, and complete lines 31c, d

&

e)

19.

'0.

21. Exemptions

22.

Total income subject to 1ax (Subtract line 21b from line 20)

22

OVERPAYMENT

27. Tax overpayment (SUbtract lines 23b and 25c from line 24; choose overpayment options on lines 28 - 30)

24.

Total payments and credits (Total from page 2, Payments and Credits schedule, line 4)

24

-----.-.------------------------------------------------------------·--------'-+"'787',7777-'0'7-"720"7:71

Interest and penalty for: failure to make

Interest

Penalty

25. estlmated tax payments; underpayment

of estimated tax; or late payment of tax

25a

28. Reserved

INCOME

ATTACH

w·'

FORMS

HERE

8.

Other gains or (losses) (Allach copy of federal Form 4797)

9.

Taxable IRA distributions

10. Taxable pensions and annuities (Attach copy of Form(s) 1099-R)

ATTACH

1.

Wages, salaries, tips, etc. ( W-2 forms must be attached)

COPY OF 2.

Taxable interest

PAGE 1

3.

Ordinary dividends

OF

FEDERAL 4.

Taxable refunds, credlts or offsets

RETURN

Alimony received

5.

6.

Business income or (loss) (Attach federal Schedule C)

Capital gain or (loss)

(Attach copy of fed. S:'h". :O"I

77 • aC ·

L

J""'U).~~t.!eg~;""'._

__ ~

.

..

..

___,ULli

_ _ .

..c'J\)L. . _ _._____

_____________._.LI~

I

ENCLOSE

CHECK

OR

MONEY

ORDER

Make sure the SSN(s) above and on Present home address (Number and street)

page 2, line 1d are correct.

Check box if you need a tax

form mailed to you next year.

r.F"O::C::';;ity=::",~.~O=O~'':y ""='-"='-'--'--jCiiy:iown-orp'os'i~oii'ice~ ~.

30. Amount of overpayment refunded {Line 27 less lines 28d and 29} (For refund to be directly deposited

10 your bank account, mark refund box, line 31a, and complete Ilne 31 c, d

&

e)

Refund amount»

30

Direct deposit refund or

31a

Refund

31,

Routing

direct withdrawal payment

(direct deposit)

number

31.

(Mark (X) appropriate box

31b

Pay tax due

31d

Account

31a or31bandcomplete

(direct Withdrawal)

number

Jines 31c, 31d and 31e)

31.

Account Type:

MAIL TO: See mailing instructions

Savings

Revised: 11/07/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12