Line-By-Line Instructions For Business Profits Tax Return (Form Nh-1041)

ADVERTISEMENT

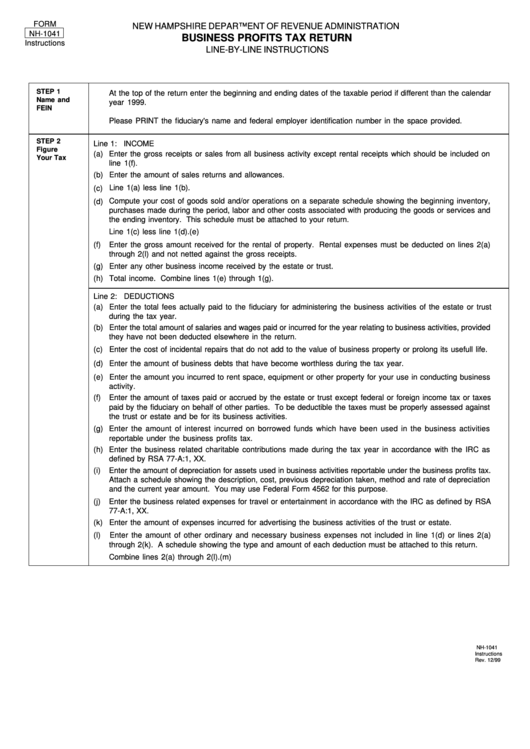

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

NH-1041

BUSINESS PROFITS TAX RETURN

Instructions

LINE-BY-LINE INSTRUCTIONS

STEP 1

At the top of the return enter the beginning and ending dates of the taxable period if different than the calendar

Name and

year 1999.

FEIN

Please PRINT the fiduciary's name and federal employer identification number in the space provided.

STEP 2

Line 1: INCOME

Figure

(a)

Enter the gross receipts or sales from all business activity except rental receipts which should be included on

Your Tax

line 1(f).

(b) Enter the amount of sales returns and allowances.

(c) Line 1(a) less line 1(b).

Compute your cost of goods sold and/or operations on a separate schedule showing the beginning inventory,

(d)

purchases made during the period, labor and other costs associated with producing the goods or services and

the ending inventory. This schedule must be attached to your return.

(e)

Line 1(c) less line 1(d).

(f)

Enter the gross amount received for the rental of property. Rental expenses must be deducted on lines 2(a)

through 2(l) and not netted against the gross receipts.

(g) Enter any other business income received by the estate or trust.

(h) Total income. Combine lines 1(e) through 1(g).

Line 2: DEDUCTIONS

(a) Enter the total fees actually paid to the fiduciary for administering the business activities of the estate or trust

during the tax year.

(b) Enter the total amount of salaries and wages paid or incurred for the year relating to business activities, provided

they have not been deducted elsewhere in the return.

(c) Enter the cost of incidental repairs that do not add to the value of business property or prolong its usefull life.

(d) Enter the amount of business debts that have become worthless during the tax year.

(e) Enter the amount you incurred to rent space, equipment or other property for your use in conducting business

activity.

(f)

Enter the amount of taxes paid or accrued by the estate or trust except federal or foreign income tax or taxes

paid by the fiduciary on behalf of other parties. To be deductible the taxes must be properly assessed against

the trust or estate and be for its business activities.

(g)

Enter the amount of interest incurred on borrowed funds which have been used in the business activities

reportable under the business profits tax.

(h)

Enter the business related charitable contributions made during the tax year in accordance with the IRC as

defined by RSA 77-A:1, XX.

(i)

Enter the amount of depreciation for assets used in business activities reportable under the business profits tax.

Attach a schedule showing the description, cost, previous depreciation taken, method and rate of depreciation

and the current year amount. You may use Federal Form 4562 for this purpose.

(j)

Enter the business related expenses for travel or entertainment in accordance with the IRC as defined by RSA

77-A:1, XX.

(k) Enter the amount of expenses incurred for advertising the business activities of the trust or estate.

(l)

Enter the amount of other ordinary and necessary business expenses not included in line 1(d) or lines 2(a)

through 2(k). A schedule showing the type and amount of each deduction must be attached to this return.

(m)

Combine lines 2(a) through 2(l).

NH-1041

Instructions

Rev. 12/99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3