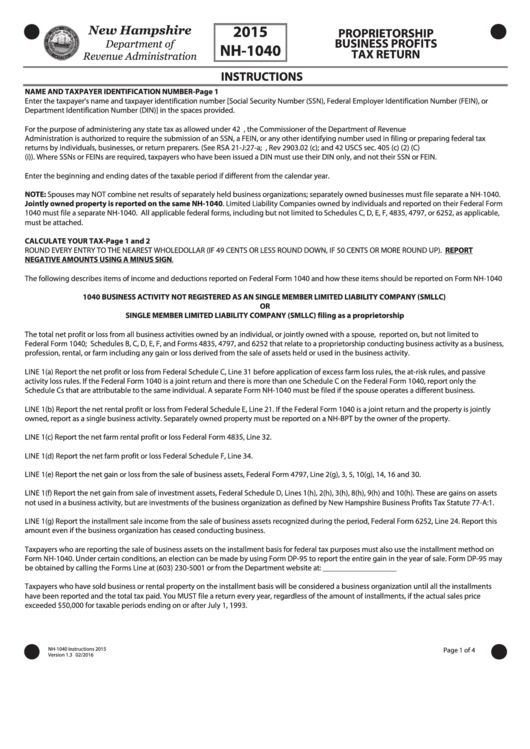

Nh-1040 Instructions - Proprietorship Business Profits Tax Return

ADVERTISEMENT

New Hampshire

2015

PROPRIETORSHIP

BUSINESS PROFITS

Department of

NH-1040

TAX RETURN

Revenue Administration

INSTRUCTIONS

NAME AND TAXPAYER IDENTIFICATION NUMBER-Page 1

Enter the taxpayer's name and taxpayer identification number [Social Security Number (SSN), Federal Employer Identification Number (FEIN), or

Department Identification Number (DIN)] in the spaces provided.

For the purpose of administering any state tax as allowed under 42 U.S.C Section 405, the Commissioner of the Department of Revenue

Administration is authorized to require the submission of an SSN, a FEIN, or any other identifying number used in filing or preparing federal tax

returns by individuals, businesses, or return preparers. (See RSA 21-J:27-a; N.H. Code of Admin. Rules, Rev 2903.02 (c); and 42 USCS sec. 405 (c) (2) (C)

(i)). Where SSNs or FEINs are required, taxpayers who have been issued a DIN must use their DIN only, and not their SSN or FEIN.

Enter the beginning and ending dates of the taxable period if different from the calendar year.

NOTE: Spouses may NOT combine net results of separately held business organizations; separately owned businesses must file separate a NH-1040.

Jointly owned property is reported on the same NH-1040. Limited Liability Companies owned by individuals and reported on their Federal Form

1040 must file a separate NH-1040. All applicable federal forms, including but not limited to Schedules C, D, E, F, 4835, 4797, or 6252, as applicable,

must be attached.

CALCULATE YOUR TAX-Page 1 and 2

ROUND EVERY ENTRY TO THE NEAREST WHOLE DOLLAR (IF 49 CENTS OR LESS ROUND DOWN, IF 50 CENTS OR MORE ROUND UP). REPORT

NEGATIVE AMOUNTS USING A MINUS SIGN.

The following describes items of income and deductions reported on Federal Form 1040 and how these items should be reported on Form NH-1040

1040 BUSINESS ACTIVITY NOT REGISTERED AS AN SINGLE MEMBER LIMITED LIABILITY COMPANY (SMLLC)

OR

SINGLE MEMBER LIMITED LIABILITY COMPANY (SMLLC) filing as a proprietorship

The total net profit or loss from all business activities owned by an individual, or jointly owned with a spouse, reported on, but not limited to

Federal Form 1040; Schedules B, C, D, E, F, and Forms 4835, 4797, and 6252 that relate to a proprietorship conducting business activity as a business,

profession, rental, or farm including any gain or loss derived from the sale of assets held or used in the business activity.

LINE 1(a) Report the net profit or loss from Federal Schedule C, Line 31 before application of excess farm loss rules, the at-risk rules, and passive

activity loss rules. If the Federal Form 1040 is a joint return and there is more than one Schedule C on the Federal Form 1040, report only the

Schedule Cs that are attributable to the same individual. A separate Form NH-1040 must be filed if the spouse operates a different business.

LINE 1(b) Report the net rental profit or loss from Federal Schedule E, Line 21. If the Federal Form 1040 is a joint return and the property is jointly

owned, report as a single business activity. Separately owned property must be reported on a NH-BPT by the owner of the property.

LINE 1(c) Report the net farm rental profit or loss Federal Form 4835, Line 32.

LINE 1(d) Report the net farm profit or loss Federal Schedule F, Line 34.

LINE 1(e) Report the net gain or loss from the sale of business assets, Federal Form 4797, Line 2(g), 3, 5, 10(g), 14, 16 and 30.

LINE 1(f) Report the net gain from sale of investment assets, Federal Schedule D, Lines 1(h), 2(h), 3(h), 8(h), 9(h) and 10(h). These are gains on assets

not used in a business activity, but are investments of the business organization as defined by New Hampshire Business Profits Tax Statute 77-A:1.

LINE 1(g) Report the installment sale income from the sale of business assets recognized during the period, Federal Form 6252, Line 24. Report this

amount even if the business organization has ceased conducting business.

Taxpayers who are reporting the sale of business assets on the installment basis for federal tax purposes must also use the installment method on

Form NH-1040. Under certain conditions, an election can be made by using Form DP-95 to report the entire gain in the year of sale. Form DP-95 may

be obtained by calling the Forms Line at (603) 230-5001 or from the Department website at:

Taxpayers who have sold business or rental property on the installment basis will be considered a business organization until all the installments

have been reported and the total tax paid. You MUST file a return every year, regardless of the amount of installments, if the actual sales price

exceeded $50,000 for taxable periods ending on or after July 1, 1993.

NH-1040 Instructions 2015

Page 1 of 4

Version 1.3 02/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4