Form Machinery And Equipment Investment Tax Credit Worksheet - State Of Maine - 2004

ADVERTISEMENT

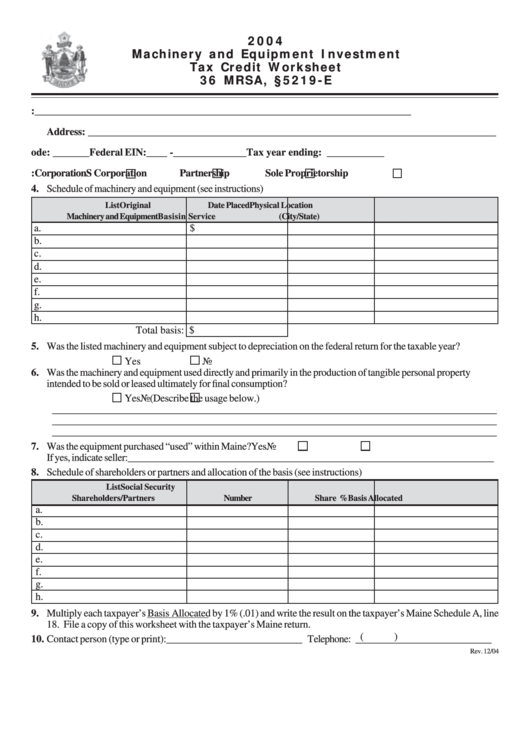

2004

Machinery and Equipment Investment

Tax Credit Worksheet

36 MRSA, §5219-E

1. Business name: ________________________________________________________________________

Address: ______________________________________________________________________________

2. Business code: _______ Federal EIN: ____ - ______________ Tax year ending: ___________

3. Business type:

Corporation

S Corporation

Partnership

Sole Proprietorship

4. Schedule of machinery and equipment (see instructions)

List

Original

Date Placed

Physical Location

Machinery and Equipment

Basis

in Service

(City/State)

a.

$

b.

c.

d.

e.

f.

g.

h.

Total basis: $

5. Was the listed machinery and equipment subject to depreciation on the federal return for the taxable year?

Yes

No

6. Was the machinery and equipment used directly and primarily in the production of tangible personal property

intended to be sold or leased ultimately for final consumption?

Yes

No

(Describe the usage below.)

_____________________________________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

7. Was the equipment purchased “used” within Maine?

Yes

No

If yes, indicate seller: ______________________________________________________________________

8. Schedule of shareholders or partners and allocation of the basis (see instructions)

List

Social Security

Shareholders/Partners

Number

Share %

Basis Allocated

a.

b.

c.

d.

e.

f.

g.

h.

9. Multiply each taxpayer’s Basis Allocated by 1% (.01) and write the result on the taxpayer’s Maine Schedule A, line

18. File a copy of this worksheet with the taxpayer’s Maine return.

(

)

10. Contact person (type or print): __________________________ Telephone: __________________________

Rev. 12/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1