Form Ct-1120 Mec - Connecticut Machinery And Equipment Expenditures Tax Credit - 2015

ADVERTISEMENT

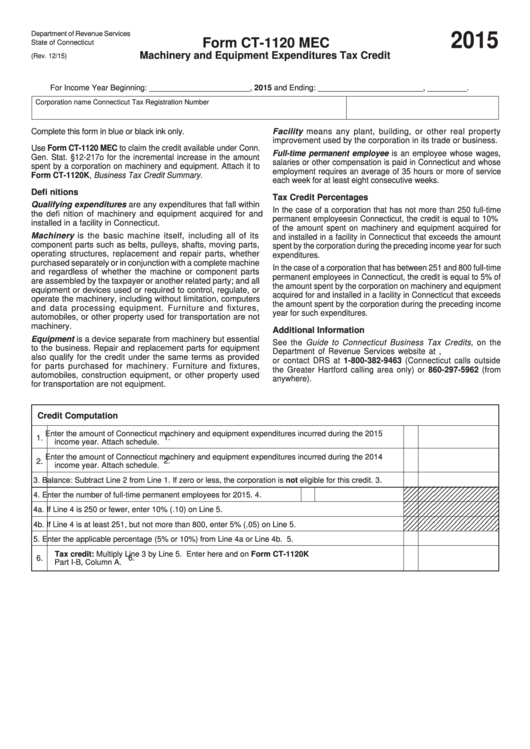

Department of Revenue Services

2015

Form CT-1120 MEC

State of Connecticut

Machinery and Equipment Expenditures Tax Credit

(Rev. 12/15)

For Income Year Beginning: _______________________ , 2015 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

Facility means any plant, building, or other real property

improvement used by the corporation in its trade or business.

Use Form CT-1120 MEC to claim the credit available under Conn.

Full-time permanent employee is an employee whose wages,

Gen. Stat. §12-217o for the incremental increase in the amount

salaries or other compensation is paid in Connecticut and whose

spent by a corporation on machinery and equipment. Attach it to

employment requires an average of 35 hours or more of service

Form CT-1120K, Business Tax Credit Summary.

each week for at least eight consecutive weeks.

Defi nitions

Tax Credit Percentages

Qualifying expenditures are any expenditures that fall within

In the case of a corporation that has not more than 250 full-time

the defi nition of machinery and equipment acquired for and

permanent employees in Connecticut, the credit is equal to 10%

installed in a facility in Connecticut.

of the amount spent on machinery and equipment acquired for

Machinery is the basic machine itself, including all of its

and installed in a facility in Connecticut that exceeds the amount

component parts such as belts, pulleys, shafts, moving parts,

spent by the corporation during the preceding income year for such

operating structures, replacement and repair parts, whether

expenditures.

purchased separately or in conjunction with a complete machine

In the case of a corporation that has between 251 and 800 full-time

and regardless of whether the machine or component parts

permanent employees in Connecticut, the credit is equal to 5% of

are assembled by the taxpayer or another related party; and all

the amount spent by the corporation on machinery and equipment

equipment or devices used or required to control, regulate, or

acquired for and installed in a facility in Connecticut that exceeds

operate the machinery, including without limitation, computers

the amount spent by the corporation during the preceding income

and data processing equipment. Furniture and fixtures,

year for such expenditures.

automobiles, or other property used for transportation are not

machinery.

Additional Information

Equipment is a device separate from machinery but essential

See the Guide to Connecticut Business Tax Credits, on the

to the business. Repair and replacement parts for equipment

Department of Revenue Services website at ,

also qualify for the credit under the same terms as provided

or contact DRS at 1-800-382-9463 (Connecticut calls outside

for parts purchased for machinery. Furniture and fixtures,

the Greater Hartford calling area only) or 860-297-5962 (from

automobiles, construction equipment, or other property used

anywhere).

for transportation are not equipment.

Credit Computation

Enter the amount of Connecticut machinery and equipment expenditures incurred during the 2015

1.

1.

income year. Attach schedule.

Enter the amount of Connecticut machinery and equipment expenditures incurred during the 2014

2.

2.

income year. Attach schedule.

3.

Balance: Subtract Line 2 from Line 1. If zero or less, the corporation is not eligible for this credit.

3.

4.

Enter the number of full-time permanent employees for 2015.

4.

4a.

If Line 4 is 250 or fewer, enter 10% (.10) on Line 5.

4b.

If Line 4 is at least 251, but not more than 800, enter 5% (.05) on Line 5.

5.

Enter the applicable percentage (5% or 10%) from Line 4a or Line 4b.

5.

Tax credit: Multiply Line 3 by Line 5. Enter here and on Form CT-1120K

6.

6.

Part I-B, Column A.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1