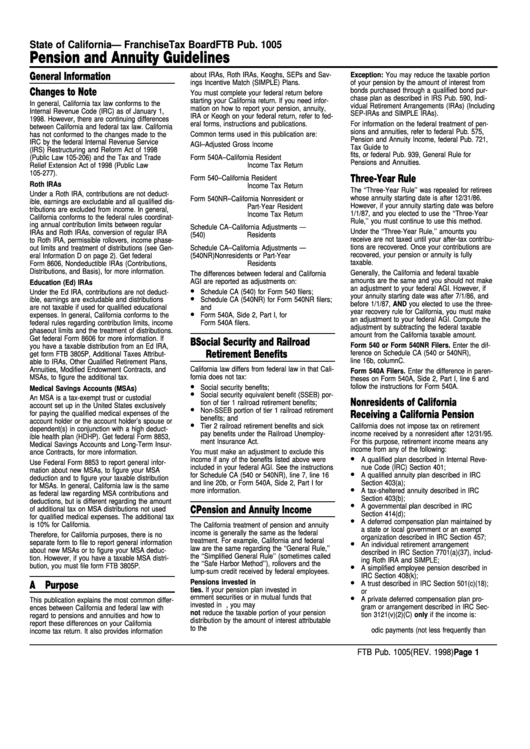

Ftb Pub. 1005 - Pension And Annuity Guidelines - Franchise Tax Board

ADVERTISEMENT

State of California — Franchise Tax Board

FTB Pub. 1005

Pension and Annuity Guidelines

General Information

about IRAs, Roth IRAs, Keoghs, SEPs and Sav-

Exception: You may reduce the taxable portion

ings Incentive Match (SIMPLE) Plans.

of your pension by the amount of interest from

Changes to Note

bonds purchased through a qualified bond pur-

You must complete your federal return before

chase plan as described in IRS Pub. 590, Indi-

starting your California return. If you need infor-

In general, California tax law conforms to the

vidual Retirement Arrangements (IRAs) (Including

mation on how to report your pension, annuity,

Internal Revenue Code (IRC) as of January 1,

SEP-IRAs and SIMPLE IRAs).

IRA or Keogh on your federal return, refer to fed-

1998. However, there are continuing differences

eral forms, instructions and publications.

For information on the federal treatment of pen-

between California and federal tax law. California

sions and annuities, refer to federal Pub. 575,

has not conformed to the changes made to the

Common terms used in this publication are:

Pension and Annuity Income, federal Pub. 721,

IRC by the federal Internal Revenue Service

AGI

– Adjusted Gross Income

Tax Guide to U.S. Civil Service Retirement Bene-

(IRS) Restructuring and Reform Act of 1998

fits, or federal Pub. 939, General Rule for

Form 540A

– California Resident

(Public Law 105-206) and the Tax and Trade

Pensions and Annuities.

Income Tax Return

Relief Extension Act of 1998 (Public Law

105-277).

Three-Year Rule

Form 540

– California Resident

Roth IRAs

Income Tax Return

The ‘‘Three-Year Rule’’ was repealed for retirees

Under a Roth IRA, contributions are not deduct-

whose annuity starting date is after 12/31/86.

Form 540NR

– California Nonresident or

ible, earnings are excludable and all qualified dis-

However, if your annuity starting date was before

Part-Year Resident

tributions are excluded from income. In general,

1/1/87, and you elected to use the ‘‘Three-Year

Income Tax Return

California conforms to the federal rules coordinat-

Rule,’’ you must continue to use this method.

ing annual contribution limits between regular

Schedule CA

– California Adjustments —

Under the ‘‘Three-Year Rule,’’ amounts you

IRAs and Roth IRAs, conversion of regular IRA

(540)

Residents

receive are not taxed until your after-tax contribu-

to Roth IRA, permissible rollovers, income phase-

tions are recovered. Once your contributions are

Schedule CA

– California Adjustments —

out limits and treatment of distributions (see Gen-

recovered, your pension or annuity is fully

eral Information D on page 2). Get federal

(540NR)

Nonresidents or Part-Year

taxable.

Residents

Form 8606, Nondeductible IRAs (Contributions,

Distributions, and Basis), for more information.

Generally, the California and federal taxable

The differences between federal and California

amounts are the same and you should not make

AGI are reported as adjustments on:

Education (Ed) IRAs

•

an adjustment to your federal AGI. However, if

Under the Ed IRA, contributions are not deduct-

Schedule CA (540) for Form 540 filers;

•

your annuity starting date was after 7/1/86, and

Schedule CA (540NR) for Form 540NR filers;

ible, earnings are excludable and distributions

before 1/1/87, AND you elected to use the three-

are not taxable if used for qualified educational

and

•

year recovery rule for California, you must make

Form 540A, Side 2, Part I, for

expenses. In general, California conforms to the

an adjustment to your federal AGI. Compute the

federal rules regarding contribution limits, income

Form 540A filers.

adjustment by subtracting the federal taxable

phaseout limits and the treatment of distributions.

amount from the California taxable amount.

Get federal Form 8606 for more information. If

B Social Security and Railroad

Form 540 or Form 540NR Filers. Enter the dif-

you have a taxable distribution from an Ed IRA,

Retirement Benefits

ference on Schedule CA (540 or 540NR),

get form FTB 3805P, Additional Taxes Attribut-

line 16b, column C.

able to IRAs, Other Qualified Retirement Plans,

Annuities, Modified Endowment Contracts, and

California law differs from federal law in that Cali-

Form 540A Filers. Enter the difference in paren-

fornia does not tax:

MSAs, to figure the additional tax.

theses on Form 540A, Side 2, Part I, line 6 and

•

follow the instructions for Form 540A.

Social security benefits;

Medical Savings Accounts (MSAs)

•

Social security equivalent benefit (SSEB) por-

An MSA is a tax-exempt trust or custodial

Nonresidents of California

tion of tier 1 railroad retirement benefits;

account set up in the United States exclusively

•

Non-SSEB portion of tier 1 railroad retirement

Receiving a California Pension

for paying the qualified medical expenses of the

benefits; and

account holder or the account holder’s spouse or

•

Tier 2 railroad retirement benefits and sick

California does not impose tax on retirement

dependent(s) in conjunction with a high deduct-

pay benefits under the Railroad Unemploy-

income received by a nonresident after 12/31/95.

ible health plan (HDHP). Get federal Form 8853,

ment Insurance Act.

For this purpose, retirement income means any

Medical Savings Accounts and Long-Term Insur-

income from any of the following:

You must make an adjustment to exclude this

ance Contracts, for more information.

•

income if any of the benefits listed above were

A qualified plan described in Internal Reve-

Use Federal Form 8853 to report general infor-

included in your federal AGI. See the instructions

nue Code (IRC) Section 401;

mation about new MSAs, to figure your MSA

•

for Schedule CA (540 or 540NR), line 7, line 16

A qualified annuity plan described in IRC

deduction and to figure your taxable distribution

and line 20b, or Form 540A, Side 2, Part I for

Section 403(a);

for MSAs. In general, California law is the same

•

more information.

A tax-sheltered annuity described in IRC

as federal law regarding MSA contributions and

Section 403(b);

deductions, but is different regarding the amount

•

A governmental plan described in IRC

C Pension and Annuity Income

of additional tax on MSA distributions not used

Section 414(d);

for qualified medical expenses. The additional tax

•

A deferred compensation plan maintained by

is 10% for California.

The California treatment of pension and annuity

a state or local government or an exempt

income is generally the same as the federal

Therefore, for California purposes, there is no

organization described in IRC Section 457;

treatment. For example, California and federal

•

separate form to file to report general information

An individual retirement arrangement

law are the same regarding the ‘‘General Rule,’’

about new MSAs or to figure your MSA deduc-

described in IRC Section 7701(a)(37), includ-

the ‘‘Simplified General Rule’’ (sometimes called

tion. However, if you have a taxable MSA distri-

ing Roth IRA and SIMPLE;

the ‘‘Safe Harbor Method’’), rollovers and the

•

bution, you must file form FTB 3805P.

A simplified employee pension described in

lump-sum credit received by federal employees.

IRC Section 408(k);

•

Pensions invested in U.S. Government securi-

A Purpose

A trust described in IRC Section 501(c)(18);

ties. If your pension plan invested in U.S. Gov-

or

•

ernment securities or in mutual funds that

A private deferred compensation plan pro-

This publication explains the most common differ-

invested in U.S. Government securities, you may

gram or arrangement described in IRC Sec-

ences between California and federal law with

not reduce the taxable portion of your pension

tion 3121(v)(2)(C) only if the income is:

regard to pensions and annuities and how to

distribution by the amount of interest attributable

1. Part of a series of substantially equal peri-

report these differences on your California

to the U.S. Government securities.

odic payments (not less frequently than

income tax return. It also provides information

FTB Pub. 1005 (REV. 1998)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8