Ftb Pub. 1008 - Federal Tax Adjustments And Your Notification Responsibilities To California - Franchise Tax Board

ADVERTISEMENT

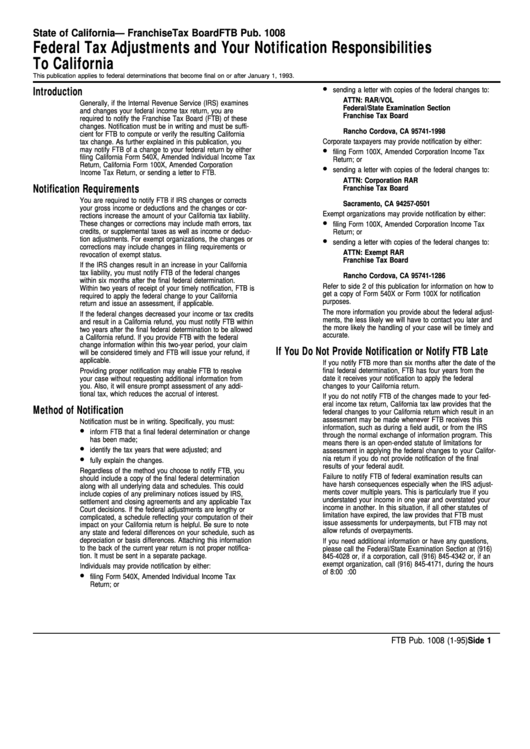

State of California — Franchise Tax Board

FTB Pub. 1008

Federal Tax Adjustments and Your Notification Responsibilities

To California

This publication applies to federal determinations that become final on or after January 1, 1993.

•

Introduction

sending a letter with copies of the federal changes to:

ATTN: RAR/VOL

Generally, if the Internal Revenue Service (IRS) examines

Federal/State Examination Section

and changes your federal income tax return, you are

Franchise Tax Board

required to notify the Franchise Tax Board (FTB) of these

P.O. Box 1998

changes. Notification must be in writing and must be suffi-

Rancho Cordova, CA 95741-1998

cient for FTB to compute or verify the resulting California

Corporate taxpayers may provide notification by either:

tax change. As further explained in this publication, you

•

may notify FTB of a change to your federal return by either

filing Form 100X, Amended Corporation Income Tax

filing California Form 540X, Amended Individual Income Tax

Return; or

Return, California Form 100X, Amended Corporation

•

sending a letter with copies of the federal changes to:

Income Tax Return, or sending a letter to FTB.

ATTN: Corporation RAR

Notification Requirements

Franchise Tax Board

P.O. Box 942857

You are required to notify FTB if IRS changes or corrects

Sacramento, CA 94257-0501

your gross income or deductions and the changes or cor-

Exempt organizations may provide notification by either:

rections increase the amount of your California tax liability.

•

These changes or corrections may include math errors, tax

filing Form 100X, Amended Corporation Income Tax

credits, or supplemental taxes as well as income or deduc-

Return; or

•

tion adjustments. For exempt organizations, the changes or

sending a letter with copies of the federal changes to:

corrections may include changes in filing requirements or

ATTN: Exempt RAR

revocation of exempt status.

Franchise Tax Board

If the IRS changes result in an increase in your California

P.O. Box 1286

tax liability, you must notify FTB of the federal changes

Rancho Cordova, CA 95741-1286

within six months after the final federal determination.

Refer to side 2 of this publication for information on how to

Within two years of receipt of your timely notification, FTB is

get a copy of Form 540X or Form 100X for notification

required to apply the federal change to your California

purposes.

return and issue an assessment, if applicable.

The more information you provide about the federal adjust-

If the federal changes decreased your income or tax credits

ments, the less likely we will have to contact you later and

and result in a California refund, you must notify FTB within

the more likely the handling of your case will be timely and

two years after the final federal determination to be allowed

accurate.

a California refund. If you provide FTB with the federal

change information within this two-year period, your claim

If You Do Not Provide Notification or Notify FTB Late

will be considered timely and FTB will issue your refund, if

applicable.

If you notify FTB more than six months after the date of the

final federal determination, FTB has four years from the

Providing proper notification may enable FTB to resolve

your case without requesting additional information from

date it receives your notification to apply the federal

changes to your California return.

you. Also, it will ensure prompt assessment of any addi-

tional tax, which reduces the accrual of interest.

If you do not notify FTB of the changes made to your fed-

eral income tax return, California tax law provides that the

Method of Notification

federal changes to your California return which result in an

assessment may be made whenever FTB receives this

Notification must be in writing. Specifically, you must:

•

information, such as during a field audit, or from the IRS

inform FTB that a final federal determination or change

through the normal exchange of information program. This

has been made;

means there is an open-ended statute of limitations for

•

identify the tax years that were adjusted; and

assessment in applying the federal changes to your Califor-

•

nia return if you do not provide notification of the final

fully explain the changes.

results of your federal audit.

Regardless of the method you choose to notify FTB, you

Failure to notify FTB of federal examination results can

should include a copy of the final federal determination

have harsh consequences especially when the IRS adjust-

along with all underlying data and schedules. This could

ments cover multiple years. This is particularly true if you

include copies of any preliminary notices issued by IRS,

understated your income in one year and overstated your

settlement and closing agreements and any applicable Tax

income in another. In this situation, if all other statutes of

Court decisions. If the federal adjustments are lengthy or

limitation have expired, the law provides that FTB must

complicated, a schedule reflecting your computation of their

issue assessments for underpayments, but FTB may not

impact on your California return is helpful. Be sure to note

allow refunds of overpayments.

any state and federal differences on your schedule, such as

depreciation or basis differences. Attaching this information

If you need additional information or have any questions,

to the back of the current year return is not proper notifica-

please call the Federal/State Examination Section at (916)

tion. It must be sent in a separate package.

845-4028 or, if a corporation, call (916) 845-4342 or, if an

exempt organization, call (916) 845-4171, during the hours

Individuals may provide notification by either:

•

of 8:00 a.m. to 4:00 p.m. for assistance.

filing Form 540X, Amended Individual Income Tax

Return; or

FTB Pub. 1008 (1-95) Side 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2