Instructions For Schedule Of Business Profits Tax Credits For Combined Groups Form Dp-160-We

ADVERTISEMENT

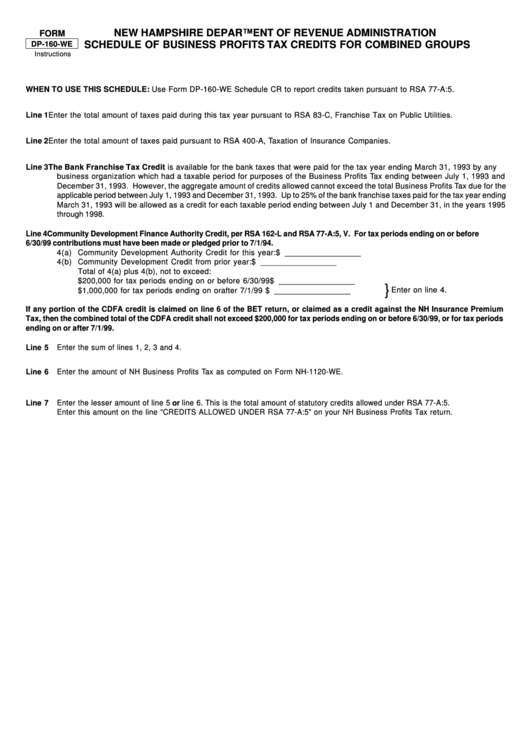

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

SCHEDULE OF BUSINESS PROFITS TAX CREDITS FOR COMBINED GROUPS

DP-160-WE

Instructions

WHEN TO USE THIS SCHEDULE: Use Form DP-160-WE Schedule CR to report credits taken pursuant to RSA 77-A:5.

Line 1

Enter the total amount of taxes paid during this tax year pursuant to RSA 83-C, Franchise Tax on Public Utilities.

Line 2

Enter the total amount of taxes paid pursuant to RSA 400-A, Taxation of Insurance Companies.

Line 3

The Bank Franchise Tax Credit is available for the bank taxes that were paid for the tax year ending March 31, 1993 by any

business organization which had a taxable period for purposes of the Business Profits Tax ending between July 1, 1993 and

December 31, 1993. However, the aggregate amount of credits allowed cannot exceed the total Business Profits Tax due for the

applicable period between July 1, 1993 and December 31, 1993. Up to 25% of the bank franchise taxes paid for the tax year ending

March 31, 1993 will be allowed as a credit for each taxable period ending between July 1 and December 31, in the years 1995

through 1998.

Line 4

Community Development Finance Authority Credit, per RSA 162-L and RSA 77-A:5, V. For tax periods ending on or before

6/30/99 contributions must have been made or pledged prior to 7/1/94.

4(a) Community Development Authority Credit for this year: ........ $ _________________

4(b) Community Development Credit from prior year: .................... $ _________________

Total of 4(a) plus 4(b), not to exceed:

$200,000 for tax periods ending on or before 6/30/99 ........... $ _________________

Enter on line 4.

$1,000,000 for tax periods ending on orafter 7/1/99 .............. $ _________________

If any portion of the CDFA credit is claimed on line 6 of the BET return, or claimed as a credit against the NH Insurance Premium

Tax, then the combined total of the CDFA credit shall not exceed $200,000 for tax periods ending on or before 6/30/99, or for tax periods

ending on or after 7/1/99.

Line 5

Enter the sum of lines 1, 2, 3 and 4.

Line 6

Enter the amount of NH Business Profits Tax as computed on Form NH-1120-WE.

Line 7

Enter the lesser amount of line 5 or line 6. This is the total amount of statutory credits allowed under RSA 77-A:5.

Enter this amount on the line “CREDITS ALLOWED UNDER RSA 77-A:5” on your NH Business Profits Tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1