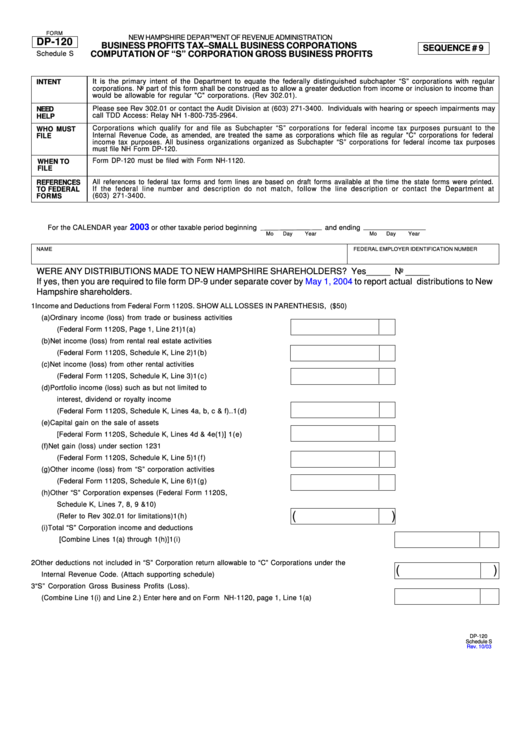

Form Dp-120 - Schedule S - Business Profits Tax - Small Business Corporations Computation Of "S" Corporation Gross Business Profits

ADVERTISEMENT

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-120

BUSINESS PROFITS TAX – SMALL BUSINESS CORPORATIONS

SEQUENCE # 9

Schedule S

COMPUTATION OF “S” CORPORATION GROSS BUSINESS PROFITS

It is the primary intent of the Department to equate the federally distinguished subchapter “S” corporations with regular

INTENT

corporations. No part of this form shall be construed as to allow a greater deduction from income or inclusion to income than

would be allowable for regular "C" corporations. (Rev 302.01).

Please see Rev 302.01 or contact the Audit Division at (603) 271-3400. Individuals with hearing or speech impairments may

NEED

call TDD Access: Relay NH 1-800-735-2964.

HELP

Corporations which qualify for and file as Subchapter “S” corporations for federal income tax purposes pursuant to the

WHO MUST

Internal Revenue Code, as amended, are treated the same as corporations which file as regular "C" corporations for federal

FILE

income tax purposes. All business organizations organized as Subchapter “S” corporations for federal income tax purposes

must file NH Form DP-120.

Form DP-120 must be filed with Form NH-1120.

WHEN TO

FILE

All references to federal tax forms and form lines are based on draft forms available at the time the state forms were printed.

REFERENCES

If the federal line number and description do not match, follow the line description or contact the Department at

TO FEDERAL

(603) 271-3400.

FORMS

2003

For the CALENDAR year

or other taxable period beginning

and ending

Mo

Day

Year

Mo

Day

Year

NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

WERE ANY DISTRIBUTIONS MADE TO NEW HAMPSHIRE SHAREHOLDERS? Yes_____ No _____

If yes, then you are required to file form DP-9 under separate cover by

May 1, 2004

to report actual distributions to New

Hampshire shareholders.

1 Income and Deductions from Federal Form 1120S. SHOW ALL LOSSES IN PARENTHESIS, e.g. ($50)

(a) Ordinary income (loss) from trade or business activities

(Federal Form 1120S, Page 1, Line 21) ............................................. 1(a)

(b) Net income (loss) from rental real estate activities

(Federal Form 1120S, Schedule K, Line 2) ....................................... 1(b)

(c) Net income (loss) from other rental activities

(Federal Form 1120S, Schedule K, Line 3) ....................................... 1(c)

(d) Portfolio income (loss) such as but not limited to

interest, dividend or royalty income

(Federal Form 1120S, Schedule K, Lines 4a, b, c & f) ..................... 1(d)

(e) Capital gain on the sale of assets

[Federal Form 1120S, Schedule K, Lines 4d & 4e(1)] ...................... 1(e)

(f)

Net gain (loss) under section 1231

(Federal Form 1120S, Schedule K, Line 5) ....................................... 1(f)

(g) Other income (loss) from “S” corporation activities

(Federal Form 1120S, Schedule K, Line 6) ....................................... 1(g)

(h) Other “S” Corporation expenses (Federal Form 1120S,

Schedule K, Lines 7, 8, 9 &10)

(

)

(Refer to Rev 302.01 for limitations) .................................................. 1(h)

(i)

Total “S” Corporation income and deductions

[Combine Lines 1(a) through 1(h)] ............................................................................................................. 1(i)

2 Other deductions not included in “S” Corporation return allowable to “C” Corporations under the

(

)

Internal Revenue Code. (Attach supporting schedule) ..................................................................................... 2

3 “S” Corporation Gross Business Profits (Loss).

(Combine Line 1(i) and Line 2.) Enter here and on Form NH-1120, page 1, Line 1(a) .................................. 3

DP-120

Schedule S

Rev. 10/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1