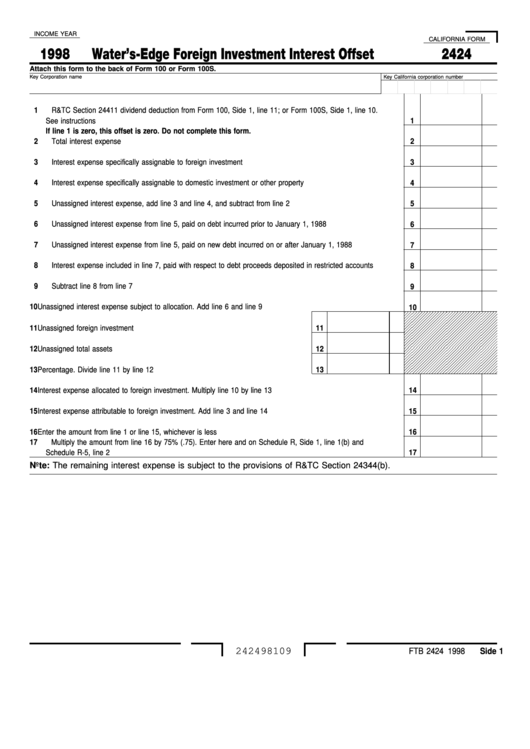

Form 2424 - Water'S-Edge Foreign Investment Interest Offset - 1998

ADVERTISEMENT

INCOME YEAR

CALIFORNIA FORM

1998

Water’s-Edge Foreign Investment Interest Offset

2424

Attach this form to the back of Form 100 or Form 100S.

Key Corporation name

Key California corporation number

1 R&TC Section 24411 dividend deduction from Form 100, Side 1, line 11; or Form 100S, Side 1, line 10.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

If line 1 is zero, this offset is zero. Do not complete this form.

2 Total interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Interest expense specifically assignable to foreign investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Interest expense specifically assignable to domestic investment or other property . . . . . . . . . . . . . . . . . . . .

4

5 Unassigned interest expense, add line 3 and line 4, and subtract from line 2 . . . . . . . . . . . . . . . . . . . . . . .

5

6 Unassigned interest expense from line 5, paid on debt incurred prior to January 1, 1988. . . . . . . . . . . . . . . .

6

7 Unassigned interest expense from line 5, paid on new debt incurred on or after January 1, 1988 . . . . . . . . . . .

7

8 Interest expense included in line 7, paid with respect to debt proceeds deposited in restricted accounts. . . . . . .

8

9 Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Unassigned interest expense subject to allocation. Add line 6 and line 9 . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Unassigned foreign investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Unassigned total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Percentage. Divide line 11 by line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Interest expense allocated to foreign investment. Multiply line 10 by line 13 . . . . . . . . . . . . . . . . . . . . . . .

14

15 Interest expense attributable to foreign investment. Add line 3 and line 14 . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Enter the amount from line 1 or line 15, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Multiply the amount from line 16 by 75% (.75). Enter here and on Schedule R, Side 1, line 1(b) and

Schedule R-5, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

Note: The remaining interest expense is subject to the provisions of R&TC Section 24344(b).

242498109

FTB 2424 1998 Side 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1