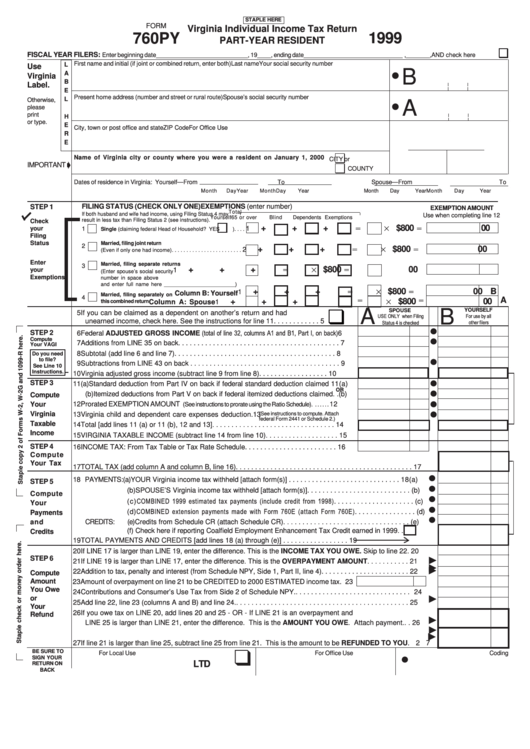

Form 760py - Virginia Individual Income Tax Return Part-Year Resident - 1999

ADVERTISEMENT

STAPLE HERE

FORM

Virginia Individual Income Tax Return

1999

760PY

PART-YEAR RESIDENT

FISCAL YEAR FILERS:

Enter beginning date ___________________________ , 19 ____ , ending date _____________________________ , _______ , AND check here

First name and initial (if joint or combined return, enter both)

Last name

Your social security number

L

Use

•

B

A

Virginia

B

Label.

E

Present home address (number and street or rural route)

Spouse’s social security number

L

Otherwise,

•

A

please

print

H

or type.

E

City, town or post office and state

ZIP Code

For Office Use

R

E

Name of Virginia city or county where you were a resident on January 1, 2000

CITY or

IMPORTANT

COUNTY

Dates of residence in Virginia: Yourself—From

To

Spouse—From

To

Month

Day

Year

Month

Day

Year

Month

Day

Year

Month

Day

Year

Month

Day

Year

Month

Day

Year

Month

Day

Year

Month Day Year

FILING STATUS (CHECK ONLY ONE)

EXEMPTIONS (enter number)

STEP 1

EXEMPTION AMOUNT

Total

If both husband and wife had income, using Filing Status 4 may

Use when completing line 12

Yourself

65 or over

Blind

Dependents Exemptions

result in less tax than Filing Status 2 (see instructions).

Check

+

+

+

$800

00

1

your

1

Single (claiming federal Head of Household? YES

) . . . .

Filing

Status

Married, filing joint return

2

+

+

+

$800

00

2

(Even if only one had income) . . . . . . . . . . . . . . . . . . . . . . . .

Enter

Married, filing separate returns

3

+

+

+

$800

00

1

your

(Enter spouse’s social security

Exemptions

number in space above

and enter full name here ________________________ )

+

+

+

$800

00 B

1

Column B: Yourself

Married, filing separately on

4

00 A

+

+

+

$800

this combined return

Column A: Spouse

1

A

SPOUSE

YOURSELF

B

5 If you can be claimed as a dependent on another’s return and had

unearned income, check here. See the instructions for line 11 . . . . . . . . . . . .

5

STEP 2

6 Federal ADJUSTED GROSS INCOME

6

Compute

7 Additions from LINE 35 on back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Your VAGI

8 Subtotal (add line 6 and line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Do you need

to file?

9 Subtractions from LINE 43 on back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

See Line 10

Instructions.

10 Virginia adjusted gross income (subtract line 9 from line 8) . . . . . . . . . . . . . . . . . . 10

STEP 3

11 (a)Standard deduction from Part IV on back if federal standard deduction claimed 11(a)

OR

(b)Itemized deductions from Part V on back if federal itemized deductions claimed. . (b)

Compute

12 Prorated EXEMPTION AMOUNT

12

Your

(See instructions to prorate using the Ratio Schedule) . . . . . . .

Virginia

13 Virginia child and dependent care expenses deduction.

(See instructions to compute. Attach

13

federal Form 2441 or Schedule 2.)

Taxable

14 Total [add lines 11 (a) or 11 (b), 12 and 13] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Income

15 VIRGINIA TAXABLE INCOME (subtract line 14 from line 10) . . . . . . . . . . . . . . . . . . . 15

STEP 4

16 INCOME TAX: From Tax Table or Tax Rate Schedule . . . . . . . . . . . . . . . . . . . . . . . . 16

Compute

Your Tax

17 TOTAL TAX (add column A and column B, line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 PAYMENTS: (a)YOUR Virginia income tax withheld [attach form(s)] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18(a)

STEP 5

(b)SPOUSE’S Virginia income tax withheld [attach form(s)] . . . . . . . . . . . . . . . . . . . . . . . . . . . (b)

Compute

(c)

. . . . . . . . . . . . . . . . . . . . . (c)

Your

(d)

. . . . . . . . . . . . . . . . (d)

Payments

and

CREDITS:

(e)Credits from Schedule CR (attach Schedule CR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (e)

(f) Check here if reporting Coalfield Employment Enhancement Tax Credit earned in 1999. .

Credits

19 TOTAL PAYMENTS AND CREDITS [add lines 18 (a) through (e)] . . . . . . . . . . . . . . . . .

19

20 If LINE 17 is larger than LINE 19, enter the difference. This is the INCOME TAX YOU OWE. Skip to line 22 . 20

STEP 6

21 If LINE 19 is larger than LINE 17, enter the difference. This is the OVERPAYMENT AMOUNT . . . . . . . . . . . 21

22 Addition to tax, penalty and interest (from Schedule NPY, Side 1, Part II, line 4) . . . . . . . . . . . . . . . . . . . . . . . 22

Compute

Amount

23 Amount of overpayment on line 21 to be CREDITED to 2000 ESTIMATED income tax. 23

You Owe

24 Contributions and Consumer’s Use Tax from Side 2 of Schedule NPY. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

or

25 Add line 22, line 23 (columns A and B) and line 24. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Your

26 If you owe tax on LINE 20, add lines 20 and 25 - OR - If LINE 21 is an overpayment and

Refund

LINE 25 is larger than LINE 21, enter the difference. This is the AMOUNT YOU OWE. Attach payment. . . 26

27 If line 21 is larger than line 25, subtract line 25 from line 21. This is the amount to be REFUNDED TO YOU. 27

BE SURE TO

For Local Use

For Office Use

Coding

SIGN YOUR

LTD

RETURN ON

BACK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2