Form Mhpe Draft - Mobile Home Park Exclusion - 2010

ADVERTISEMENT

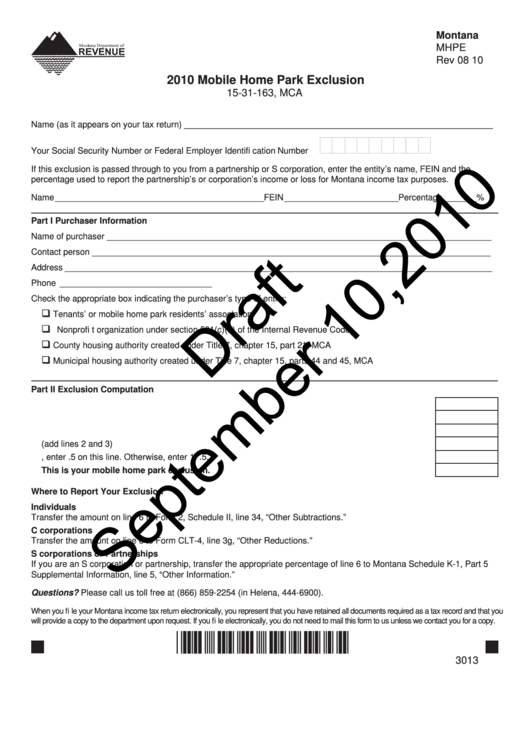

Montana

MHPE

Rev 08 10

2010 Mobile Home Park Exclusion

15-31-163, MCA

Name (as it appears on your tax return) _________________________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number

If this exclusion is passed through to you from a partnership or S corporation, enter the entity’s name, FEIN and the

percentage used to report the partnership’s or corporation’s income or loss for Montana income tax purposes.

Name ____________________________________________ FEIN ________________________ Percentage _______ %

Part I

Purchaser Information

Name of purchaser _________________________________________________________________________________

Contact person ____________________________________________________________________________________

Address __________________________________________________________________________________________

Phone ________________________________

Check the appropriate box indicating the purchaser’s type of entity:

Tenants’ or mobile home park residents’ association

Nonprofi t organization under section 501(c)(3) of the Internal Revenue Code

County housing authority created under Title 7, chapter 15, part 21, MCA

Municipal housing authority created under Title 7, chapter 15, parts 44 and 45, MCA

Part II Exclusion Computation

1. Total number of lots in the mobile home park when sold................................................................. 1.

2. Capital gains recognized ................................................................................................................. 2.

3. Ordinary income recognized............................................................................................................ 3.

4. Total gain recognized (add lines 2 and 3) ........................................................................................ 4.

5. If the number of lots reported on line 1 is more than 50, enter .5 on this line. Otherwise, enter 1. . 5.

6. Multiply line 4 by line 5 and enter the result. This is your mobile home park exclusion. ............ 6.

Where to Report Your Exclusion

Individuals

Transfer the amount on line 6 to Form 2, Schedule II, line 34, “Other Subtractions.”

C corporations

Transfer the amount on line 6 to Form CLT-4, line 3g, “Other Reductions.”

S corporations or Partnerships

If you are an S corporation or partnership, transfer the appropriate percentage of line 6 to Montana Schedule K-1, Part 5

Supplemental Information, line 5, “Other Information.”

Questions? Please call us toll free at (866) 859-2254 (in Helena, 444-6900).

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required as a tax record and that you

will provide a copy to the department upon request. If you fi le electronically, you do not need to mail this form to us unless we contact you for a copy.

*30130101*

3013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2