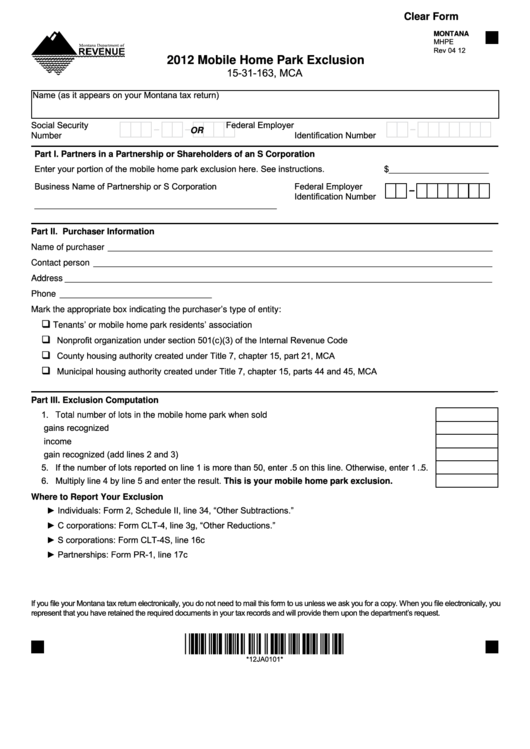

Clear Form

MONTANA

MHPE

Rev 04 12

2012 Mobile Home Park Exclusion

15-31-163, MCA

Name (as it appears on your Montana tax return)

Social Security

Federal Employer

-

-

-

OR

Identification Number

Number

Part I. Partners in a Partnership or Shareholders of an S Corporation

Enter your portion of the mobile home park exclusion here. See instructions.

$_____________________

Business Name of Partnership or S Corporation

Federal Employer

-

Identification Number

___________________________________________________

Part II. Purchaser Information

Name of purchaser _________________________________________________________________________________

Contact person ____________________________________________________________________________________

Address __________________________________________________________________________________________

Phone ________________________________

Mark the appropriate box indicating the purchaser’s type of entity:

q

Tenants’ or mobile home park residents’ association

q

Nonprofit organization under section 501(c)(3) of the Internal Revenue Code

q

County housing authority created under Title 7, chapter 15, part 21, MCA

q

Municipal housing authority created under Title 7, chapter 15, parts 44 and 45, MCA

Part III. Exclusion Computation

1. Total number of lots in the mobile home park when sold................................................................. 1.

2. Capital gains recognized ................................................................................................................. 2.

3. Ordinary income recognized............................................................................................................ 3.

4. Total gain recognized (add lines 2 and 3) . ....................................................................................... 4.

5. If the number of lots reported on line 1 is more than 50, enter .5 on this line. Otherwise, enter 1 .. 5.

6. Multiply line 4 by line 5 and enter the result. This is your mobile home park exclusion. . ........... 6.

Where to Report Your Exclusion

► Individuals: Form 2, Schedule II, line 34, “Other Subtractions.”

► C corporations: Form CLT-4, line 3g, “Other Reductions.”

► S corporations: Form CLT-4S, line 16c

► Partnerships: Form PR-1, line 17c

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*12JA0101*

*12JA0101*

1

1 2

2