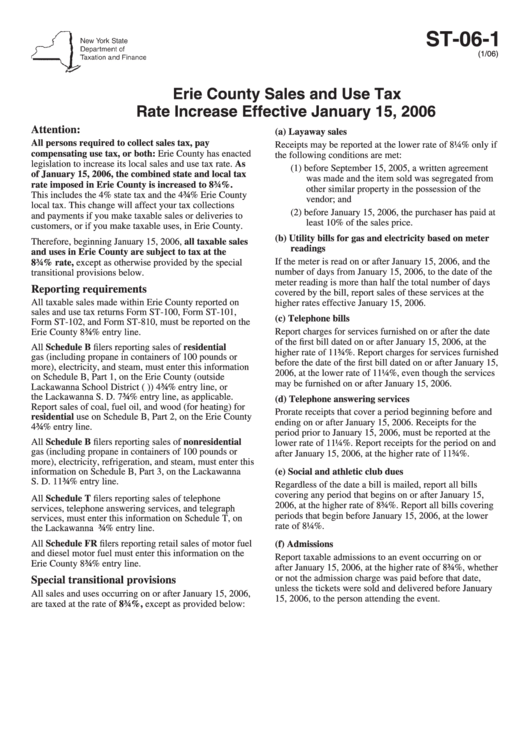

Instructions For Erie County Sales And Use Tax Rate Increase Effective Form St-06-1 2006

ADVERTISEMENT

ST-06-1

(1/06)

Erie County Sales and Use Tax

Rate Increase Effective January 15, 2006

Attention:

(a) Layaway sales

All persons required to collect sales tax, pay

Receipts may be reported at the lower rate of 8¼% only if

compensating use tax, or both: Erie County has enacted

the following conditions are met:

legislation to increase its local sales and use tax rate. As

(1) before September 15, 2005, a written agreement

of January 15, 2006, the combined state and local tax

was made and the item sold was segregated from

rate imposed in Erie County is increased to 8¾%.

other similar property in the possession of the

This includes the 4% state tax and the 4¾% Erie County

vendor; and

local tax. This change will affect your tax collections

(2) before January 15, 2006, the purchaser has paid at

and payments if you make taxable sales or deliveries to

least 10% of the sales price.

customers, or if you make taxable uses, in Erie County.

(b) Utility bills for gas and electricity based on meter

Therefore, beginning January 15, 2006, all taxable sales

readings

and uses in Erie County are subject to tax at the

If the meter is read on or after January 15, 2006, and the

8¾% rate, except as otherwise provided by the special

number of days from January 15, 2006, to the date of the

transitional provisions below.

meter reading is more than half the total number of days

Reporting requirements

covered by the bill, report sales of these services at the

All taxable sales made within Erie County reported on

higher rates effective January 15, 2006.

sales and use tax returns Form ST-100, Form ST-101,

(c) Telephone bills

Form ST-102, and Form ST-810, must be reported on the

Report charges for services furnished on or after the date

Erie County 8¾% entry line.

of the first bill dated on or after January 15, 2006, at the

All Schedule B filers reporting sales of residential

higher rate of 11¾%. Report charges for services furnished

gas (including propane in containers of 100 pounds or

before the date of the first bill dated on or after January 15,

more), electricity, and steam, must enter this information

2006, at the lower rate of 11¼%, even though the services

on Schedule B, Part 1, on the Erie County (outside

may be furnished on or after January 15, 2006.

Lackawanna School District (S.D.)) 4¾% entry line, or

the Lackawanna S. D. 7¾% entry line, as applicable.

(d) Telephone answering services

Report sales of coal, fuel oil, and wood (for heating) for

Prorate receipts that cover a period beginning before and

residential use on Schedule B, Part 2, on the Erie County

ending on or after January 15, 2006. Receipts for the

4¾% entry line.

period prior to January 15, 2006, must be reported at the

All Schedule B filers reporting sales of nonresidential

lower rate of 11¼%. Report receipts for the period on and

gas (including propane in containers of 100 pounds or

after January 15, 2006, at the higher rate of 11¾%.

more), electricity, refrigeration, and steam, must enter this

information on Schedule B, Part 3, on the Lackawanna

(e) Social and athletic club dues

S. D. 11¾% entry line.

Regardless of the date a bill is mailed, report all bills

covering any period that begins on or after January 15,

All Schedule T filers reporting sales of telephone

2006, at the higher rate of 8¾%. Report all bills covering

services, telephone answering services, and telegraph

periods that begin before January 15, 2006, at the lower

services, must enter this information on Schedule T, on

rate of 8¼%.

the Lackawanna S.D. 11¾% entry line.

All Schedule FR filers reporting retail sales of motor fuel

(f) Admissions

and diesel motor fuel must enter this information on the

Report taxable admissions to an event occurring on or

Erie County 8¾% entry line.

after January 15, 2006, at the higher rate of 8¾%, whether

or not the admission charge was paid before that date,

Special transitional provisions

unless the tickets were sold and delivered before January

All sales and uses occurring on or after January 15, 2006,

15, 2006, to the person attending the event.

are taxed at the rate of 8¾%, except as provided below:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2