Form W-3 - Reconciliation Of Norwalk Income Tax Withheld From Wages

ADVERTISEMENT

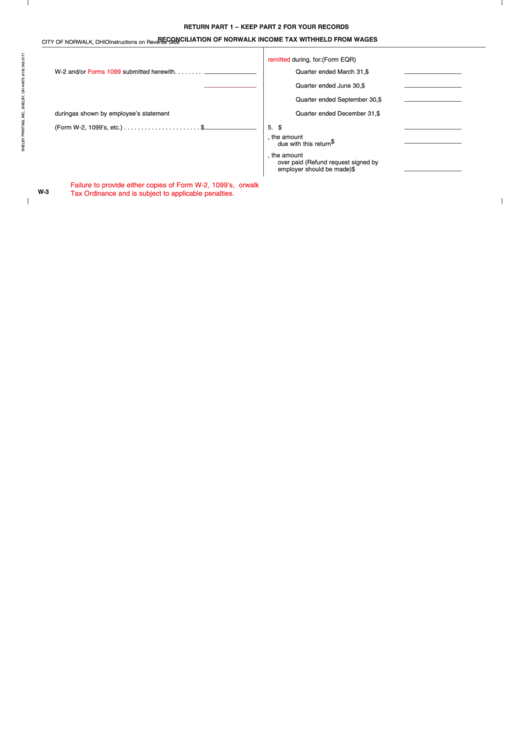

RETURN PART 1 – KEEP PART 2 FOR YOUR RECORDS

RECONCILIATION OF NORWALK INCOME TAX WITHHELD FROM WAGES

CITY OF NORWALK, OHIO

Instructions on Reverse Side

1. Total number of employees represented by Forms

4. Total Norwalk Income Tax

remitted

during

, for: (Form EQR)

W-2 and/or

Forms 1099

submitted herewith. . . . . . . .

Quarter ended March 31,

$

2. Gross wages subject to Norwalk Income Tax. . . . . . .

Quarter ended June 30,

$

3. Total NORWALK Income Tax withheld from wages

Quarter ended September 30,

$

during

as shown by employee’s statement

Quarter ended December 31,

$

(Form W-2, 1099’s, etc.) . . . . . . . . . . . . . . . . . . . . . . $

5. TOTAL ............................................................$

6a. Line 3 is greater than Line 5, the amount

$

due with this return

6b. Line 5 is greater than Line 3, the amount

over paid (Refund request signed by

employer should be made)

$

Failure to provide either copies of Form W-2, 1099’s, etc. or a printout containing the same information is a violation of the Norwalk

W-3

Tax Ordinance and is subject to applicable penalties.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1