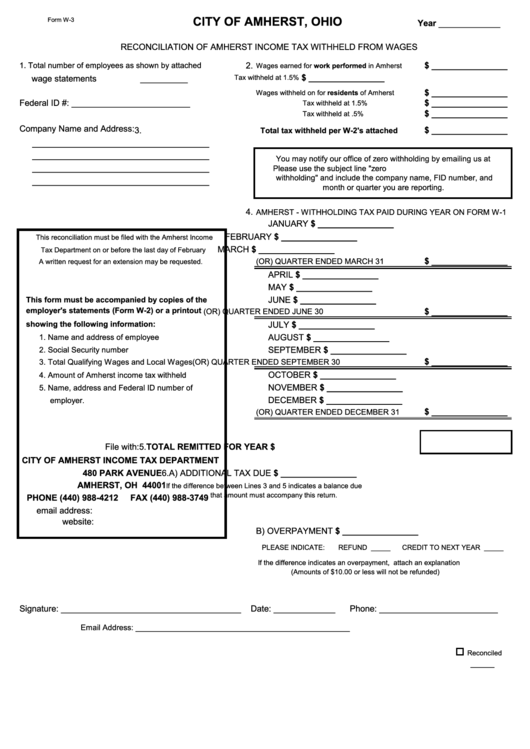

Form W-3 - Reconciliation Of Amherst Income Tax Withheld From Wages

ADVERTISEMENT

CITY OF AMHERST, OHIO

Form W-3

Year _____________

RECONCILIATION OF AMHERST INCOME TAX WITHHELD FROM WAGES

1. Total number of employees as shown by attached

2.

$ ________________

Wages earned for work performed in Amherst

$ ________________

Tax withheld at 1.5%

wage statements

__________

$ ________________

Wages withheld on for residents of Amherst

Federal ID #: _________________________

$ ________________

Tax withheld at 1.5%

$ ________________

Tax withheld at .5%

Company Name and Address:

3.

$ ________________

Total tax withheld per W-2's attached

_______________________________

_______________________________

You may notify our office of zero withholding by emailing us at

_______________________________

. Please use the subject line "zero

withholding" and include the company name, FID number, and

_______________________________

month or quarter you are reporting.

______________________________________

4.

AMHERST - WITHHOLDING TAX PAID DURING YEAR ON FORM W-1

JANUARY

$ ________________

FEBRUARY

$ ________________

This reconciliation must be filed with the Amherst Income

MARCH

$ ________________

Tax Department on or before the last day of February

$ ________________

(OR) QUARTER ENDED MARCH 31

A written request for an extension may be requested.

APRIL

$ ________________

MAY

$ ________________

JUNE

$ ________________

This form must be accompanied by copies of the

employer's statements (Form W-2) or a printout

$ ________________

(OR) QUARTER ENDED JUNE 30

showing the following information:

JULY

$ ________________

1. Name and address of employee

AUGUST

$ ________________

2. Social Security number

SEPTEMBER

$ ________________

$ ________________

3. Total Qualifying Wages and Local Wages

(OR) QUARTER ENDED SEPTEMBER 30

OCTOBER

$ ________________

4. Amount of Amherst income tax withheld

NOVEMBER

$ ________________

5. Name, address and Federal ID number of

DECEMBER

$ ________________

employer.

$ ________________

(OR) QUARTER ENDED DECEMBER 31

File with:

5. TOTAL REMITTED FOR YEAR

$

CITY OF AMHERST INCOME TAX DEPARTMENT

480 PARK AVENUE

6. A) ADDITIONAL TAX DUE

$ ________________

AMHERST, OH 44001

If the difference between Lines 3 and 5 indicates a balance due

that amount must accompany this return.

PHONE (440) 988-4212

FAX (440) 988-3749

email address:

website:

B) OVERPAYMENT

$ ________________

PLEASE INDICATE:

REFUND _____

CREDIT TO NEXT YEAR _____

If the difference indicates an overpayment, attach an explanation

(Amounts of $10.00 or less will not be refunded)

Signature: ______________________________________

Date: _____________

Phone: _________________________

Email Address: _________________________________________________

Reconciled

_____

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1