Form Ar1000rc5 - Certificate For Developmentally Disabled Individual

ADVERTISEMENT

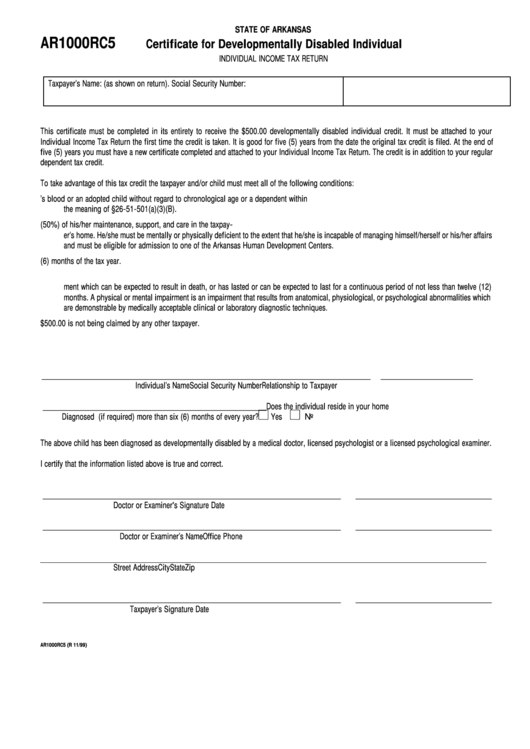

STATE OF ARKANSAS

AR1000RC5

Certificate for Developmentally Disabled Individual

INDIVIDUAL INCOME TAX RETURN

Taxpayer’s Name: (as shown on return).

Social Security Number:

This certificate must be completed in its entirety to receive the $500.00 developmentally disabled individual credit. It must be attached to your

Individual Income Tax Return the first time the credit is taken. It is good for five (5) years from the date the original tax credit is filed. At the end of

five (5) years you must have a new certificate completed and attached to your Individual Income Tax Return. The credit is in addition to your regular

dependent tax credit.

To take advantage of this tax credit the taxpayer and/or child must meet all of the following conditions:

1.

The Individual shall include a person of the taxpayer’s blood or an adopted child without regard to chronological age or a dependent within

the meaning of §26-51-501(a)(3)(B).

2.

The individual must be dependent on the taxpayer for more than fifty percent (50%) of his/her maintenance, support, and care in the taxpay-

er’s home. He/she must be mentally or physically deficient to the extent that he/she is incapable of managing himself/herself or his/her affairs

and must be eligible for admission to one of the Arkansas Human Development Centers.

3.

The individual has NOT resided in any of the Arkansas Human Development Centers more than six (6) months of the tax year.

4.

The individual must be unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impair-

ment which can be expected to result in death, or has lasted or can be expected to last for a continuous period of not less than twelve (12)

months. A physical or mental impairment is an impairment that results from anatomical, physiological, or psychological abnormalities which

are demonstrable by medically acceptable clinical or laboratory diagnostic techniques.

5.

This $500.00 is not being claimed by any other taxpayer.

______________________________________________________

_____________________

_____________________

Individual’s Name

Social Security Number

Relationship to Taxpayer

_________________________ __________________________

Does the individual reside in your home

Diagnosed Disability

I.Q. Score (if required)

more than six (6) months of every year?

Yes

No

The above child has been diagnosed as developmentally disabled by a medical doctor, licensed psychologist or a licensed psychological examiner.

I certify that the information listed above is true and correct.

____________________________________________________________________

_______________________________

Doctor or Examiner's Signature

Date

____________________________________________________________________

_______________________________

Doctor or Examiner’s Name

Office Phone

Street Address

City

State

Zip

____________________________________________________________________

_______________________________

Taxpayer’s Signature

Date

AR1000RC5 (R 11/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1