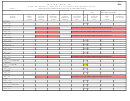

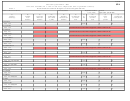

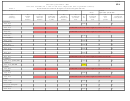

Form 85a - Kansas Schedule 1 - Ifta Fuel Tax Computation (Ifta Qualified Vehicles) Second Quarter - 2007 Page 4

ADVERTISEMENT

FORM

85A

SECOND QUARTER - 2007

KANSAS SCHEDULE 1 - IFTA Fuel Tax Computation (IFTA Qualified Vehicles)

PAGE 4

Round amounts in Columns B through F to nearest whole gallon and mile

NAME AS SHOWN ON FORM 85

IFTA License Number

Tax Period

M-85

April 1, 2007 - June 30, 2007

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

Jurisdiction

Total Miles

Total Taxable

Taxable Gallons

Total Gallons

Net Taxable Gals

Tax

Tax Due/Credit

Interest

Total Due/Credit

and Fuel Type

in each

Miles in each

(Col. C divided

Purchased in each

(Col. D minus

Rate

(Col. F times

at 1%

(Col. H plus Col. I)

Jurisdiction

Jurisdiction

by AMG )

Jurisdiction

Col. E)

Col. G)

per month

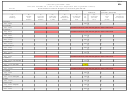

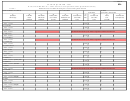

50 ALBERTA

.2900 $

$

$

51010 M-85

51 BRITISH COLUMBIA

52010

M-85

No M-85 fuel use tax, enter miles and gallons to balance with form 85

52 MANITOBA

.3705 $

$

$

53010

M-85

53 NEW BRUNSWICK

54010 M-85

No M-85 fuel use tax, enter miles and gallons to balance with form 85

59 NEWFOUNDLAND

60010 M-85

No M-85 fuel use tax, enter miles and gallons to balance with form 85

57 NOVA SCOTIA

No M-85 fuel use tax, enter miles and gallons to balance with form 85

58010

M-85

54 ONTARIO

.4735 $

$

$

55010

M-85

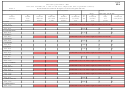

58 PRINCE EDWARD

59010

M-85

No M-85 fuel use tax, enter miles and gallons to balance with form 85

55 QUEBEC

.4896 $

$

$

56010

M-85

56 SASKATCHEWAN

.4832 $

$

$

57010

M-85

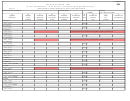

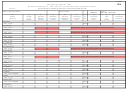

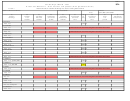

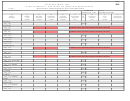

91 91010

All Other

Jurisdictions

92 92010 TOTALS

PLEASE TOTAL ALL COLUMNS DOWN FOR LINE 92/92010

****************

Total for column (E 92/92010) must match column

****************

Total for column (B 92/92010) should match column

(B) on front of your return for Total miles traveled

(C) on front of your return for Total gallons purchased

in all jurisdictions.

in all jurisdictions.

Be sure to follow through on next page, and fill out any Surcharge's that apply for those states traveled.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5