Form Epa 0320 - Facility Annual Chemical Inventory Filing Fee Worksheet

ADVERTISEMENT

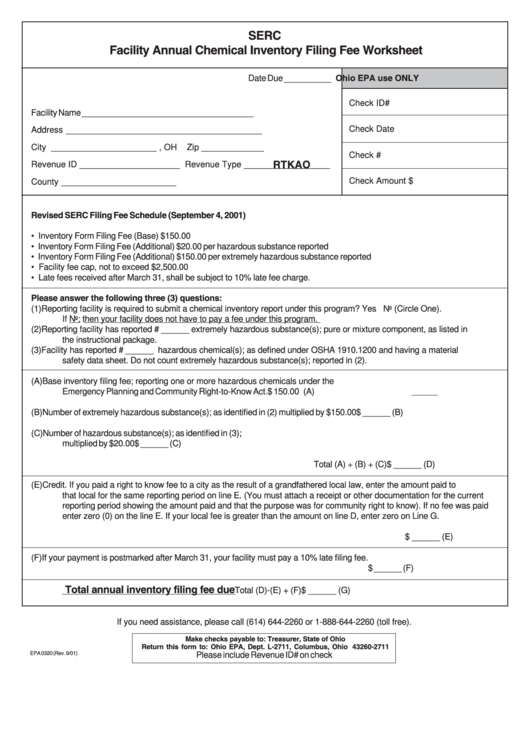

SERC

Facility Annual Chemical Inventory Filing Fee Worksheet

Ohio EPA use ONLY

Date Due __________

Check ID#

Facility Name _____________________________________

Check Date

Address _________________________________________

City ______________________ , OH

Zip _____________

Check #

RTKAO

Revenue ID _____________________ Revenue Type __________________

Check Amount $

County ________________________

Revised SERC Filing Fee Schedule (September 4, 2001)

• Inventory Form Filing Fee (Base) $150.00

• Inventory Form Filing Fee (Additional) $20.00 per hazardous substance reported

• Inventory Form Filing Fee (Additional) $150.00 per extremely hazardous substance reported

• Facility fee cap, not to exceed $2,500.00

• Late fees received after March 31, shall be subject to 10% late fee charge.

Please answer the following three (3) questions:

(1)

Reporting facility is required to submit a chemical inventory report under this program? Yes No (Circle One).

If No; then your facility does not have to pay a fee under this program.

(2)

Reporting facility has reported # ______ extremely hazardous substance(s); pure or mixture component, as listed in

the instructional package.

(3)

Facility has reported # ______ hazardous chemical(s); as defined under OSHA 1910.1200 and having a material

safety data sheet. Do not count extremely hazardous substance(s); reported in (2).

(A)

Base inventory filing fee; reporting one or more hazardous chemicals under the

Emergency Planning and Community Right-to-Know Act.

$ 150.00 (A)

(B)

Number of extremely hazardous substance(s); as identified in (2) multiplied by $150.00

$ ______ (B)

(C)

Number of hazardous substance(s); as identified in (3);

multiplied by $20.00

$ ______ (C)

Total (A) + (B) + (C)

$ ______ (D)

(E)

Credit. If you paid a right to know fee to a city as the result of a grandfathered local law, enter the amount paid to

that local for the same reporting period on line E. (You must attach a receipt or other documentation for the current

reporting period showing the amount paid and that the purpose was for community right to know). If no fee was paid

enter zero (0) on the line E. If your local fee is greater than the amount on line D, enter zero on Line G.

$ ______ (E)

(F)

If your payment is postmarked after March 31, your facility must pay a 10% late filing fee.

$ ______ (F)

Total annuaI inventory filing fee due

Total (D)-(E) + (F)

$ ______ (G)

If you need assistance, please call (614) 644-2260 or 1-888-644-2260 (toll free).

Make checks payable to: Treasurer, State of Ohio

Return this form to: Ohio EPA, Dept. L-2711, Columbus, Ohio 43260-2711

EPA 0320 (Rev. 9/01)

Please include Revenue ID# on check

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1