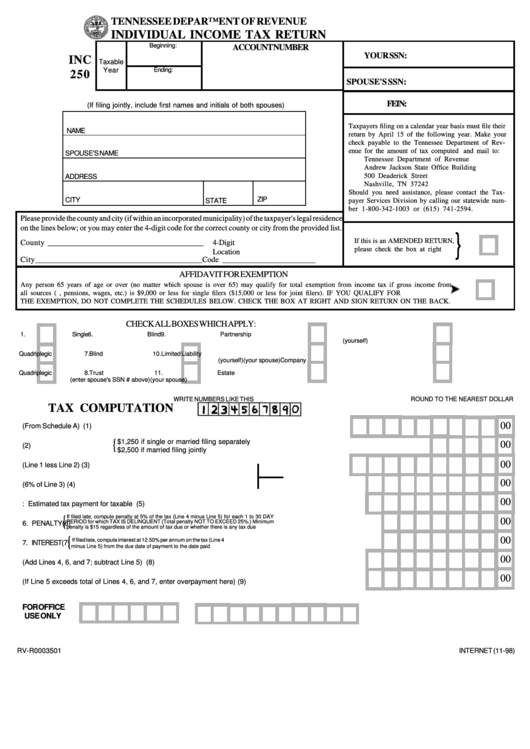

TENNESSEE DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX RETURN

Beginning:

ACCOUNT NUMBER

YOUR SSN:

INC

Taxable

Year

Ending:

250

SPOUSE'S SSN:

FEIN:

(If filing jointly, include first names and initials of both spouses)

Taxpayers filing on a calendar year basis must file their

NAME

return by April 15 of the following year. Make your

check payable to the Tennessee Department of Rev-

enue for the amount of tax computed and mail to:

SPOUSE'S NAME

Tennessee Department of Revenue

Andrew Jackson State Office Building

500 Deaderick Street

ADDRESS

Nashville, TN 37242

Should you need assistance, please contact the Tax-

ZIP

CITY

payer Services Division by calling our statewide num-

STATE

ber 1-800-342-1003 or (615) 741-2594.

Please provide the county and city (if within an incorporated municipality) of the taxpayer's legal residence

on the lines below; or you may enter the 4-digit code for the correct county or city from the provided list.

}

If this is an AMENDED RETURN,

County ________________________________________

4-Digit

please check the box at right

Location

City ___________________________________________

Code ________________________

AFFIDAVIT FOR EXEMPTION

Any person 65 years of age or over (no matter which spouse is over 65) may qualify for total exemption from income tax if gross income from

all sources (i.e. social security, pensions, wages, etc.) is $9,000 or less for single filers ($15,000 or less for joint filers). IF YOU QUALIFY FOR

THE EXEMPTION, DO NOT COMPLETE THE SCHEDULES BELOW. CHECK THE BOX AT RIGHT AND SIGN RETURN ON THE BACK.

CHECK ALL BOXES WHICH APPLY:

1 .

Single

6.

Blind

9.

Partnership

(yourself)

2.

Married Filing Jointly

4.

Quadriplegic

7.

Blind

10.

Limited Liability

(yourself)

(your spouse)

Company

3.

Married Filing Separately

5.

Quadriplegic

8.

Trust

1 1 .

Estate

(enter spouse's SSN # above)

(your spouse)

WRITE NUMBERS LIKE THIS

ROUND TO THE NEAREST DOLLAR

TAX COMPUTATION

00

1. TOTAL TAXABLE INCOME (From Schedule A) ................................................................... (1)

{

$1,250 if single or married filing separately

00

2. SUBTRACT EXEMPTION

............................. (2)

$2,500 if married filing jointly

00

3. AMOUNT SUBJECT TO TAX (Line 1 less Line 2) .............................

(3)

00

4. INCOME TAX (6% of Line 3) .............................................................

(4)

00

5. ENTER: Estimated tax payment for taxable year ................................................................ (5)

If filed late, compute penalty at 5% of the tax (Line 4 minus Line 5) for each 1 to 30 DAY

{

00

PERIOD for which TAX IS DELINQUENT (Total penalty NOT TO EXCEED 25%.) Minimum

6. PENALTY

................ (6)

penalty is $15 regardless of the amount of tax due or whether there is any tax due

{

00

If filed late, compute interest at 12.50% per annum on the tax (Line 4

7. INTEREST

........................................ (7)

minus Line 5) from the due date of payment to the date paid

00

8. TOTAL AMOUNT DUE (Add Lines 4, 6, and 7; subtract Line 5) ......................................... (8)

00

9. REFUND (If Line 5 exceeds total of Lines 4, 6, and 7, enter overpayment here) .............. (9)

FOR OFFICE

USE ONLY

RV-R0003501

INTERNET (11-98)

1

1 2

2