Form Inc 250 - Individual Income Tax Return

ADVERTISEMENT

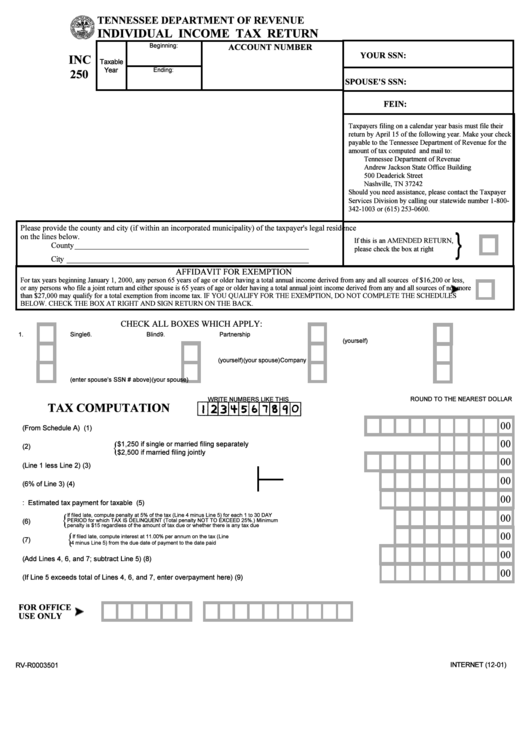

TENNESSEE DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX RETURN

ACCOUNT NUMBER

YOUR SSN:

INC

250

SPOUSE'S SSN:

FEIN:

Please provide the county and city (if within an incorporated municipality) of the taxpayer's legal residence

}

on the lines below.

County _____________________________________________________________

City _______________________________________________________________

AFFIDAVIT FOR EXEMPTION

CHECK ALL BOXES WHICH APPLY:

TAX COMPUTATION

00

{

00

00

00

00

{

If filed late, compute penalty at 5% of the tax (Line 4 minus Line 5) for each 1 to 30 DAY

00

PERIOD for which TAX IS DELINQUENT (Total penalty NOT TO EXCEED 25%.) Minimum

penalty is $15 regardless of the amount of tax due or whether there is any tax due

{

00

If filed late, compute interest at 11.00% per annum on the tax (Line

4 minus Line 5) from the due date of payment to the date paid

00

00

FOR OFFICE

USE ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2