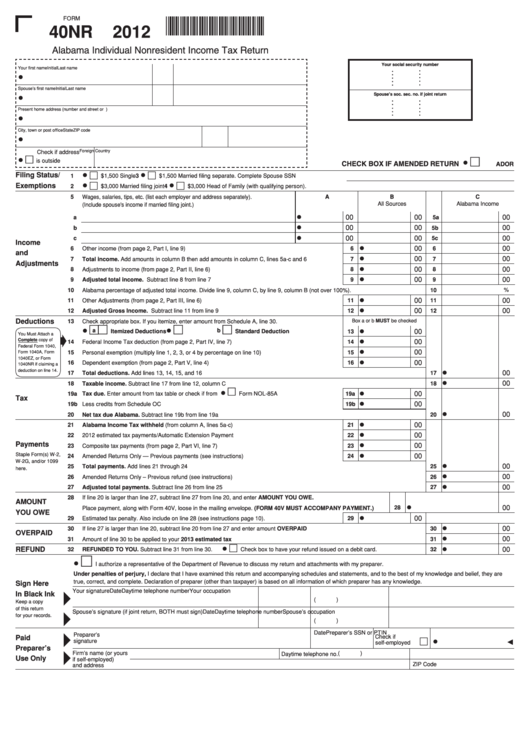

Form 40nr - Alabama Individual Nonresident Income Tax Return - 2012

ADVERTISEMENT

FORM

1200014N

40NR 2012

Alabama Individual Nonresident Income Tax Return

Your social security number

. .

. .

Your first name

Initial

Last name

. .

. .

•

.

.

Spouse’s first name

Initial

Last name

Spouse's soc. sec. no. if joint return

•

. .

. .

. .

. .

Present home address (number and street or P.O. Box number)

.

.

•

City, town or post office

State

ZIP code

•

Check if address

Foreign Country

•

is outside U.S.

•

CHECK BOX IF AMENDED RETURN

ADOR

•

•

Filing Status/

1

$1,500 Single

3

$1,500 Married filing separate. Complete Spouse SSN

•

•

Exemptions

2

$3,000 Married filing joint

4

$3,000 Head of Family (with qualifying person).

5

Wages, salaries, tips, etc. (list each employer and address separately).

A

B

C

Ala.Tax Withheld

All Sources

Alabama Income

(Include spouse's income if married filing joint.)

•

00

00

00

a

5a

•

00

00

00

b

5b

•

00

00

00

c

5c

Income

•

00

00

6

Other income (from page 2, Part I, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

and

•

00

00

7

Total income. Add amounts in column B then add amounts in column C, lines 5a-c and 6. . . . . . . . . . . .

7

7

Adjustments

•

00

00

8

Adjustments to income (from page 2, Part II, line 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8

•

00

00

9

Adjusted total income. Subtract line 8 from line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9

%

10

Alabama percentage of adjusted total income. Divide line 9, column C, by line 9, column B (not over 100%). . . . . . . . . . . . . . . . . . . . . . . . . .

10

•

00

00

11

Other Adjustments (from page 2, Part III, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11

•

00

00

12

Adjusted Gross Income. Subtract line 11 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12

Deductions

13

Check appropriate box. If you itemize, enter amount from Schedule A, line 30.

Box a or b MUST be checked

•

•

•

a

b

00

Itemized Deductions

Standard Deduction

13

You Must Attach a

•

Complete copy of

00

14

Federal Income Tax deduction (from page 2, Part IV, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

Federal Form 1040,

•

00

15

Personal exemption (multiply line 1, 2, 3, or 4 by percentage on line 10). . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Form 1040A, Form

1040EZ, or Form

•

00

16

Dependent exemption (from page 2, Part V, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

1040NR if claiming a

deduction on line 14.

•

00

17

Total deductions. Add lines 13, 14, 15, and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

•

00

18

Taxable income. Subtract line 17 from line 12, column C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

•

•

00

19a

Tax due. Enter amount from tax table or check if from

Form NOL-85A . . . . . . . . . . . . . . . . . . . . . .

19a

Tax

•

00

19b

Less credits from Schedule OC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19b

•

00

20

Net tax due Alabama. Subtract line 19b from line 19a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

•

00

21

Alabama Income Tax withheld (from column A, lines 5a-c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

•

00

22

2012 estimated tax payments/Automatic Extension Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

Payments

•

00

23

Composite tax payments (from page 2, Part VI, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

•

Staple Form(s) W-2,

00

24

Amended Returns Only — Previous payments (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

W-2G, and/or 1099

•

00

25

Total payments. Add lines 21 through 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

here.

•

00

26

Amended Returns Only – Previous refund (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

•

00

27

Adjusted total payments. Subtract line 26 from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28

If line 20 is larger than line 27, subtract line 27 from line 20, and enter AMOUNT YOU OWE.

AMOUNT

•

00

28

Place payment, along with Form 40V, loose in the mailing envelope. (FORM 40V MUST ACCOMPANY PAYMENT.)

YOU OWE

•

00

29

Estimated tax penalty. Also include on line 28 (see instructions page 10). . . . . . . . . . . . . . . . . . . . . . . . . . .

29

•

00

30

If line 27 is larger than line 20, subtract line 20 from line 27 and enter amount OVERPAID . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

OVERPAID

•

00

31

Amount of line 30 to be applied to your 2013 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

•

•

REFUND

00

32

REFUNDED TO YOU. Subtract line 31 from line 30.

Check box to have your refund issued on a debit card.. . . . . . . . . . . . . . . . .

32

•

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign Here

Your signature

Date

Daytime telephone number

Your occupation

In Black Ink

(

)

Keep a copy

of this return

Spouse’s signature (if joint return, BOTH must sign)

Date

Daytime telephone number

Spouse’s occupation

for your records.

(

)

Date

Preparer’s SSN or PTIN

Preparer’s

Paid

Check if

•

signature

self-employed

Preparer’s

Firm’s name (or yours

Daytime telephone no. (

)

E.I. No.

Use Only

if self-employed)

ZIP Code

and address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2