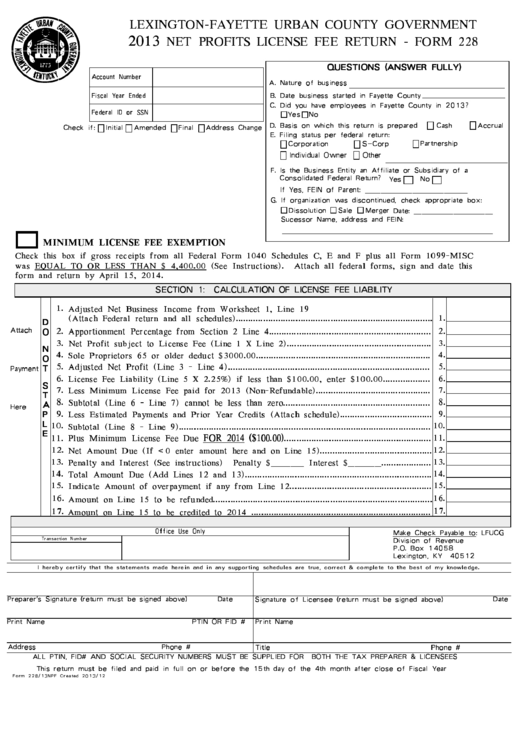

Form 228 - 2013 Net Profits License Fee Return

ADVERTISEMENT

ABC

LEXINGTON−FAYETTE URBAN COUNTY GOVERNMENT

NET PROFITS LICENSE FEE RETURN − FORM 228

2013

DEF

QUESTIONS (ANSWER FULLY)

Account Number

A. Nature of business

B. Date business started in Fayette County

Fiscal Year Ended

C. Did you have employees in Fayette County in 2013?

Federal ID or SSN

Yes No

D. Basis on which this return is prepared

Cash

Accrual

Check if:

Initial

Amended

Final

Address Change

E. Filing status per federal return:

Corporation

S−Corp

Partnership

Individual Owner

Other

F. Is the Business Entity an Affiliate or Subsidiary of a

Consolidated Federal Return?

Yes

No

If Yes, FEIN of Parent: _____________

G. If organization was discontinued, check appropriate box:

Dissolution

Sale

Merger

Date: __________

Sucessor Name, address and FEIN:

MINIMUM LICENSE FEE EXEMPTION

Check this box if gross receipts from all Federal Form 1040 Schedules C, E and F plus all Form 1099−MISC

EQUAL TO OR LESS THAN $ 4,400.00 (

was

See Instructions). Attach all federal forms, sign and date this

form and return by April 15, 2014.

SECTION 1: CALCULATION OF LICENSE FEE LIABILITY

1. Adjusted Net Business Income from Worksheet 1, Line 19

1.

(Attach Federal return and all schedules)...............................................................................

D

O

Attach

2. Apportionment Percentage from Section 2 Line 4.................................................................

2.

3.

3.

Net Profit subject to License Fee (Line 1 X Line 2)..........................................................

N

4.

4.

Sole Proprietors 65 or older deduct $3000.00......................................................................

O

T

5.

5.

Adjusted Net Profit (Line 3 − Line 4).................................................................................

Payment

6.

License Fee Liability (Line 5 X 2.25%) if less than $100.00, enter $100.00...................

6.

S

7.

7.

Less Minimum License Fee paid for 2013 (Non−Refundable)..............................................

T

8.

8.

A

Subtotal (Line 6 − Line 7) cannot be less than zero...........................................................

Here

P

9.

Less Estimated Payments and Prior Year Credits (Attach schedule).....................................

9.

L

10.

10.

Subtotal (Line 8 − Line 9).....................................................................................................

E

11. Plus Minimum License Fee Due

...........................................................

11.

FOR 2014 ($100.00)

12.

12.

Net Amount Due (If

0 enter amount here and on Line 15).............................................

<

13.

13.

Penalty and Interest (See instructions) Penalty $_____ Interest $_____....................

14. Total Amount Due (Add Lines 12 and 13)...........................................................................

14.

15.

15.

Indicate Amount of overpayment if any from Line 12.........................................................

16.

16.

Amount on Line 15 to be refunded........................................................................................

17. Amount on Line 15 to be credited to 2014 ........................................................................

17.

Office Use Only

Make Check Payable to: LFUCG

Division of Revenue

Transaction Number

P.O. Box 14058

Lexington, KY 40512

I hereby certify that the statements made herein and in any supporting schedules are true, correct & complete to the best of my knowledge.

Preparer's Signature (return must be signed above)

Date

Date

Signature of Licensee (return must be signed above)

Print Name

PTIN OR FID # Print Name

Address

Phone #

Title

Phone #

ALL PTIN, FID# AND SOCIAL SECURITY NUMBERS MUST BE SUPPLIED FOR BOTH THE TAX PREPARER & LICENSEES

This return must be filed and paid in full on or before the 15th day of the 4th month after close of Fiscal Year

Form 228/13NPF Created 2013/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2