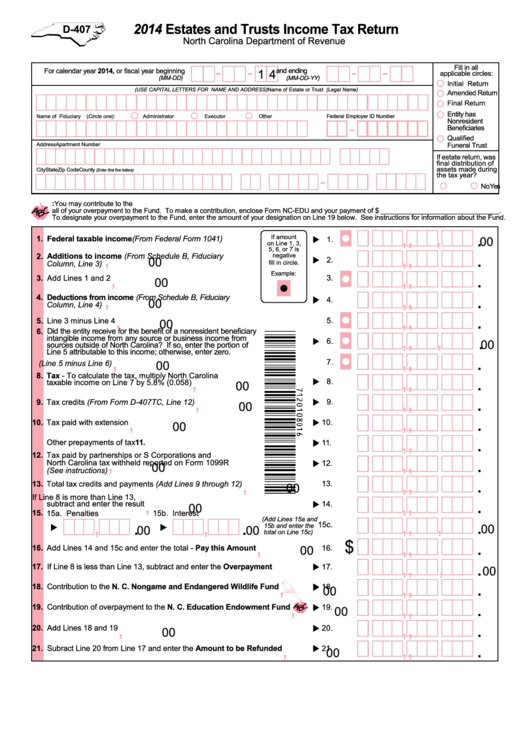

Form D-407 Draft - Estates And Trusts Income Tax Return - 2014

ADVERTISEMENT

2014 Estates and Trusts Income Tax Return

D-407

North Carolina Department of Revenue

Fill in all

For calendar year 2014, or fiscal year beginning

and ending

1 4

applicable circles:

(MM-DD)

(MM-DD-YY)

Initial Return

Name of Estate or Trust (Legal Name)

(USE CAPITAL LETTERS FOR NAME AND ADDRESS)

Amended Return

Final Return

Entity has

Federal Employer ID Number

Name of Fiduciary

(Circle one):

Administrator

Executor

Other

Nonresident

Beneficiaries

Qualified

Address

Apartment Number

Funeral Trust

If estate return, was

final distribution of

assets made during

City

State

Zip Code

County

(Enter first five letters)

the tax year?

Yes

No

N.C. Education Endowment Fund: You may contribute to the N.C. Education Endowment Fund by making a contribution or designating some or

all of your overpayment to the Fund. To make a contribution, enclose Form NC-EDU and your payment of $ _______________________________.

To designate your overpayment to the Fund, enter the amount of your designation on Line 19 below. See instructions for information about the Fund.

,

,

,

.

If amount

1. Federal taxable income (From Federal Form 1041)

00

1.

on Line 1, 3,

,

,

,

5, 6, or 7 is

.

2. Additions to income (From Schedule B, Fiduciary

negative

2.

00

fill in circle.

Column, Line 3)

,

,

,

.

Example:

3.

3. Add Lines 1 and 2

00

,

,

,

.

4. Deductions from income (From Schedule B, Fiduciary

4.

00

Column, Line 4)

,

,

,

.

5.

5. Line 3 minus Line 4

00

6. Did the entity receive for the benefit of a nonresident beneficiary

,

,

,

.

intangible income from any source or business income from

6.

00

sources outside of North Carolina? If so, enter the portion of

Line 5 attributable to this income; otherwise, enter zero.

,

,

,

.

7.

00

7. North Carolina taxable income (Line 5 minus Line 6)

,

,

,

.

8. Tax - To calculate the tax, multiply North Carolina

8.

taxable income on Line 7 by 5.8% (0.058)

00

,

,

,

.

9. Tax credits (From Form D-407TC, Line 12)

9.

00

,

,

,

.

10. Tax paid with extension

10.

00

,

,

,

.

11.

Other prepayments of tax

11.

00

12. Tax paid by partnerships or S Corporations and

,

,

,

.

North Carolina tax withheld reported on Form 1099R

12.

00

(See instructions)

,

,

,

.

13. Total tax credits and payments (Add Lines 9 through 12)

13.

00

14. Tax Due - If Line 8 is more than Line 13,

,

,

,

.

subtract and enter the result

14.

00

15. 15a. Penalties

15b. Interest

,

,

,

.

,

,

.

.

(Add Lines 15a and

15c.

15b and enter the

00

00

00

total on Line 15c)

,

,

,

.

$

16. Add Lines 14 and 15c and enter the total - Pay this Amount

16.

00

,

,

,

.

17. If Line 8 is less than Line 13, subtract and enter the Overpayment

17.

00

,

,

,

.

18. Contribution to the N. C. Nongame and Endangered Wildlife Fund

18.

00

,

,

,

.

19. Contribution of overpayment to the N. C. Education Endowment Fund

19.

00

,

,

,

.

20. Add Lines 18 and 19

20.

00

,

,

,

.

21. Subract Line 20 from Line 17 and enter the Amount to be Refunded

21.

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5