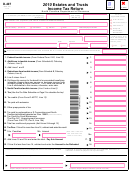

Form D-407 Draft - Estates And Trusts Income Tax Return - 2014 Page 2

ADVERTISEMENT

Page 2

Legal Name (First 10 Characters)

Federal Employer ID Number

D-407

2014

Estate Information:

Trust Information:

Date Trust Created

Date of Decedent’s Death

Name and Address

of Grantor

If no return filed last year,

reason why

If no return filed last year,

reason why

Schedule A. North Carolina Fiduciary Adjustments (See instructions)

Additions to Income

.

1. Interest income from obligations of states other than North Carolina

1.

00

.

2. Other additions to income (See instructions)

2.

00

.

3.

Total additions to income (Add lines 1 and 2)

3.

00

Apportion the additions on Line 3 between the beneficiaries and the fiduciary on Schedule B, Line 3 below

Deductions from Income

.

4. Interest income from obligations of the United States or United States’ possessions

4.

00

.

5. Taxable portion of Social Security and Railroad Retirement benefits

5.

00

.

6. Retirement benefits received from vested N. C. State government, N. C. local government,

6.

00

or federal government retirees (Bailey Settlement – Important: See Instructions)

.

7. State, local, or foreign income tax refunds reported as income on federal return

7.

00

8. Adjustment for bonus depreciation added back in 2009, 2010, 2011, 2012, and 2013

8a. 2009

8b. 2010

8c. 2011

8d. 2012

8e. 2013

.

.

.

.

.

00

00

00

00

00

.

(Add Lines 8a, 8b, 8c, 8d, and 8e, and enter total on Line 8f)

8f.

00

9. Adjustment for section 179 expense deduction added back in 2010, 2011, 2012, and 2013 (See instructions)

9a. 2010

9b. 2011

9c. 2012

9d. 2013

.

.

.

.

00

00

00

00

.

9e.

(Add Lines 9a, 9b, 9c, and 9d and enter total on Line 9e)

00

.

10. Other deductions from income (See instructions)

10.

00

.

11. Total deductions from income (Add Lines 4, 5, 6, 7, 8f, 9e, and 10)

11.

00

Apportion the deductions on Line 11 between the beneficiaries and the fiduciary on Schedule B, Line 4 below

Important

Schedule B. Apportionment of Adjustments

(See instructions)

If more than three beneficiaries, include separate schedule for additional beneficiaries.

Fiduciary

Beneficiary 1

Beneficiary 2

Beneficiary 3

Attach other pages if needed.

1.

Identifying Number

2.

Name

3.

Additions

4.

Deductions

Important:

The fiduciary must provide each beneficiary an NC K-1 for Form D-407 or other information necessary for the beneficiary to prepare

the appropriate North Carolina Income Tax Return.

I certify that, to the best of my knowledge, this return is accurate and complete.

If prepared by a person other than fiduciary, this certification is based on all information

of which the preparer has any knowledge.

Signature of Fiduciary Representing Estate or Trust

Signature of Preparer Other Than Fiduciary

Date

Date

Address

Daytime Telephone Number (Include area code)

Preparer’s Daytime Telephone Number (Include area code)

MAIL TO: NC Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0640

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5