Form 31-116a - Energy Used For Fully Taxable Purposes Page 2

ADVERTISEMENT

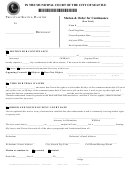

Iowa Sales Tax Computation Certificate

Energy Used That Does Not Qualify For Iowa Sales Tax Phase Out

PERCENTAGE CALCULATION

Complete the calculation below to obtain the percentage of energy used that is fully subject to Iowa Sales Tax. If

documentation cannot be completed on this form, attach additional pages. Fully taxable energy may be for

commercial purposes or non-metered energy.

Period used for basis of computation. Consider seasonal operations when selecting period.

__________________ through ___________________ Type of Fuel _________________________

(A)

(B)

Fully Taxable

Energy Used

Hours

Total

Activity

(watts/ccf)/hour

of Use

(A x B)

Lighting

_____________________________

x

_______________

=

_________________________

Heating

_____________________________

_______________

_________________________

Office Equip.

_____________________________

_______________

_________________________

Refrigeration

_____________________________

_______________

_________________________

Maintenance

_____________________________

_______________

_________________________

Air Conditioning

_____________________________

_______________

_________________________

Other, specify

_____________________________

_______________

_________________________

Other, specify

_____________________________

_______________

_________________________

Other, specify

_____________________________

_______________

_________________________

Other, specify

_____________________________

_______________

_________________________

(1) TOTAL WHICH IS FULLY SUBJECT TO TAX

____________________________________

(2) TOTAL ENERGY USED FOR ALL PURPOSES

____________________________________

(3) FULLY TAXED

_________________________________ %

(DIVIDE LINE 1 BY LINE 2)

31-116b (11/08/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2