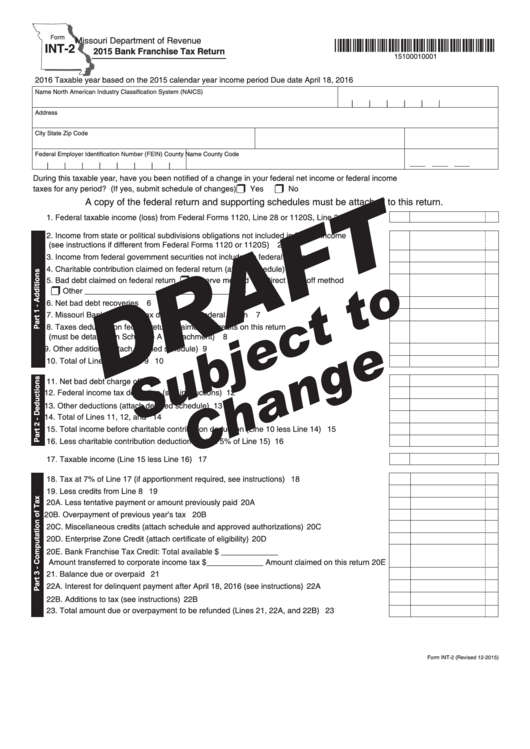

Form Int-2 Draft - Bank Franchise Tax Return - 2015

ADVERTISEMENT

Form

Missouri Department of Revenue

*15100010001*

INT-2

2015 Bank Franchise Tax Return

15100010001

2016 Taxable year based on the 2015 calendar year income period

Due date April 18, 2016

Name

North American Industry Classification System (NAICS)

|

|

|

|

|

|

Address

City

State

Zip Code

Federal Employer Identification Number (FEIN)

County Name

County Code

|

|

|

|

|

|

|

|

During this taxable year, have you been notified of a change in your federal net income or federal income

r

r

taxes for any period? (If yes, submit schedule of changes) .........................................................................................

Yes

No

A copy of the federal return and supporting schedules must be attached to this return.

1. Federal taxable income (loss) from Federal Forms 1120, Line 28 or 1120S, Line 21 ................

1

2. Income from state or political subdivisions obligations not included in federal income

(see instructions if different from Federal Forms 1120 or 1120S) ...............................................

2

3. Income from federal government securities not included in federal income ...............................

3

4. Charitable contribution claimed on federal return (attach schedule) ...........................................

4

r

r

5. Bad debt claimed on federal return

Reserve method

Direct write-off method

r

Other __________________________________ .................................................................

5

6. Net bad debt recoveries ..............................................................................................................

6

7. Missouri Bank Franchise tax deducted on federal return ............................................................

7

8. Taxes deducted on federal return, claimed as credits on this return

(must be detailed on Schedule A or attachment) ........................................................................

8

9. Other additions (attach detailed schedule)..................................................................................

9

10. Total of Lines 1 through 9 ........................................................................................................... 10

11. Net bad debt charge offs ............................................................................................................. 11

12. Federal income tax deduction (see instructions)......................................................................... 12

13. Other deductions (attach detailed schedule)............................................................................... 13

14. Total of Lines 11, 12, and 13....................................................................................................... 14

15. Total income before charitable contribution deduction (Line 10 less Line 14) ............................ 15

16. Less charitable contribution deduction (limit is 5% of Line 15) .................................................. 16

17. Taxable income (Line 15 less Line 16) ....................................................................................... 17

18. Tax at 7% of Line 17 (if apportionment required, see instructions) ............................................. 18

19. Less credits from Line 8 .............................................................................................................. 19

20A. Less tentative payment or amount previously paid ..................................................................... 20A

20B. Overpayment of previous year’s tax ........................................................................................... 20B

20C. Miscellaneous credits (attach schedule and approved authorizations) ....................................... 20C

20D. Enterprise Zone Credit (attach certificate of eligibility) ................................................................ 20D

20E. Bank Franchise Tax Credit: Total available $ _____________

Amount transferred to corporate income tax $_____________ Amount claimed on this return 20E

21. Balance due or overpaid ............................................................................................................. 21

22A. Interest for delinquent payment after April 18, 2016 (see instructions) ....................................... 22A

22B. Additions to tax (see instructions) ............................................................................................... 22B

23. Total amount due or overpayment to be refunded (Lines 21, 22A, and 22B) ............................. 23

Form INT-2 (Revised 12-2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5