Print

Clear

l

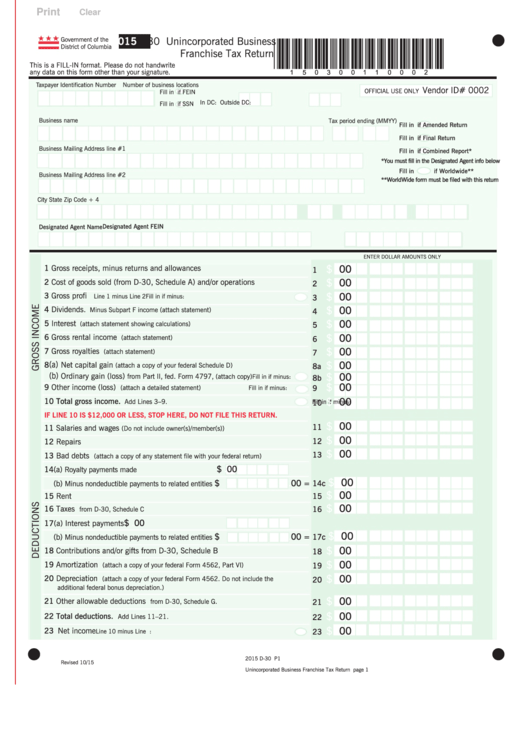

2015

D-30 Unincorporated Business

Government of the

*150300110002*

District of Columbia

Franchise Tax Return

This is a FILL-IN format. Please do not handwrite

any data on this form other than your signature.

Taxpayer Identification N umber

Number of business locations

Vendor ID# 0002

OFFICIAL USE ONLY

Fill in

if FEIN

In DC:

Outside DC:

Fill in

if SSN

Business name

Tax period ending (MMYY)

Fill in

if Amended Return

Fill in

if Final Return

Business Mailing Address line #1

Fill in

if Combined Report*

*You must fill in the Designated Agent info below

Fill in

if Worldwide**

Business Mailing Address line #2

**WorldWide form must be filed with this return

City

State

Zip Code + 4

Designated Agent FEIN

Designated Agent Name

ENTER DOLLAR AMOUNTS ONLY

.

$

00

1

Gross receipts, minus returns and allowances

1

.

$

00

2

Cost of goods sold (from D-30, Schedule A) and/or operations

2

.

$

00

3

Gross profi

Line 1 minus Line 2

Fill in if minus:

3

.

$

00

4

Dividends.

Minus Subpart F income (attach statement)

4

.

00

$

5

Interest

(attach statement showing calculations)

5

.

$

00

6

Gross rental income

(attach statement)

6

.

$

00

7

Gross royalties

(attach statement)

7

.

(a)

$

00

8

Net capital gain

(attach a copy of your federal Schedule D)

8a

.

(b)

$

00

Ordinary gain (loss)

from Part II, fed. Form 4797

, (attach copy)

8b

Fill in if minus:

.

$

00

9

Other income (loss)

9

(attach a detailed statement)

Fill in if minus:

.

$

00

10 Total gross income.

Add Lines 3–9.

Fill in if minus:

10

IF LINE 10 IS $12,000 OR LESS, STOP HERE, DO NOT FILE THIS RETURN.

.

$

00

11

11 Salaries and wages

(Do not include owner(s)/member(s))

.

00

$

12

12 Repairs

.

$

00

13

13 Bad debts

(attach a copy of any statement file with your federal return)

$

.00

14(a)

Royalty payments made

.

$

00

$

.00

(b)

=

14c

Minus nondeductible payments to related entities

.

$

00

15 Rent

15

.

$

00

16 Taxes

16

from D-30, Schedule C

$

.00

17(a) Interest payments

.

$

00

$

.00

(b)

=

17c

Minus nondeductible payments to related entities

.

$

00

18 Contributions and/or gifts from D-30, Schedule B

18

.

$

00

19 Amortization

(attach a copy of your federal Form 4562, Part VI)

19

.

$

00

20 Depreciation

(attach a copy of your federal Form 4562. Do not include the

20

additional federal bonus depreciation.)

.

$

00

21 Other allowable deductions

from D-30, Schedule G.

21

.

$

00

22 Total deductions.

Add Lines 11–21.

22

.

$

00

23 Net income

23

Line 10 minus Line 22.

Fill in if minus:

l

l

2015 D-30 P1

Revised 10/15

Unincorporated Business Franchise Tax Return page 1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9