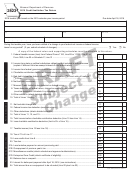

Form 2823 Draft - 2015 Credit Institution Tax Return - Missouri Department Of Revenue Page 4

ADVERTISEMENT

Part 2

Part 3

Line 11 Enter the excess, if any, of bad debt charge offs over

Line 18 Multiply the taxable income amount on Line 17 by 7%

current year recoveries. Attach schedule of bad debt computation.

and enter the amount.

Line 12 Enter the current year deduction for federal income tax

Line 19 Enter the amount from Line 8.

related to the Credit Institution tax. The current year deduction will

Line 20 Subtract Line 19 from Line 18 and enter amount. If

be the amount actually accrued (if an accrual basis taxpayer) or

amount on Line 19 exceeds amount on Line 18, enter “none”.

paid (if a cash basis taxpayer) during the year. Attach a schedule

of the computation.

Line 21A Enter the amount of tentative payment, if applicable.

Accrual basis taxpayers that are members of an affiliated group

Line 21B Enter overpayment of previous year’s tax.

filing a consolidated federal income tax return shall allocate a

Line 21C Enter the amount of tax credits claimed from the list

portion of the consolidated federal tax liability for the year by using

below. Attach a schedule listing the amounts for each tax credit. A

the same method used by the group under Internal Revenue

copy of the approved authorization must be attached to the return.

Code Section 1552 without regard to any additional allocations

under Treasury Regulation 1.1502-33(d).

Line 21D Enter the approved Enterprise Zone Credit claimed.

To be eligible for this credit, you must use the percentage from the

Cash basis taxpayers that are members of an affiliated group

second paragraph of the Department of Economic Development

filing a consolidated federal income tax return shall allocate each

(DED) certification letter and attach this to the return. Compute

component of the consolidated federal tax paid (or refunded)

the allowable Enterprise Zone Credit using the greater of the

during the year by using the same method used by the group

following two methods.

under Internal Revenue Code Section 1552 for the applicable

year without regard to any additional allocations under Treasury

1. Line 17 (taxable income) x DED percentage of income x 7%

Regulation 1.1502-33(d).

or

2. Line 18 (tax liability) x DED percentage of tax

Line 13

Enter the total amount of any deduction claimed on this

return and not included on the federal return. These deductions

Line 22 Subtract Lines 21A through 21D from Line 20.

must be itemized on a schedule attached to this return.

Line 23 Calculate interest for period which tax payment is

Line 14 Enter the total of Lines 11 through 13.

delinquent. Interest should be calculated from the due date of

April 18 through date of payment at the annual rate. The annual

Line 15 Subtract Line 14 from Line 10 and enter amount. If “loss”,

interest rate can be obtained from the Department’s website at:

indicate by brackets “( )” and enter “none” on Line 18.

Line 16 Enter the charitable contribution claimed on this return.

Line 24 Enter the total of Lines 22 and 23. If a balance due, submit

The contribution deduction is limited to 5% of taxable income

this amount.

before the contribution deduction. Only current year contributions

are allowed. Attach a schedule.

Line 17 Subtract Line 16 from Line 15 and enter amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5