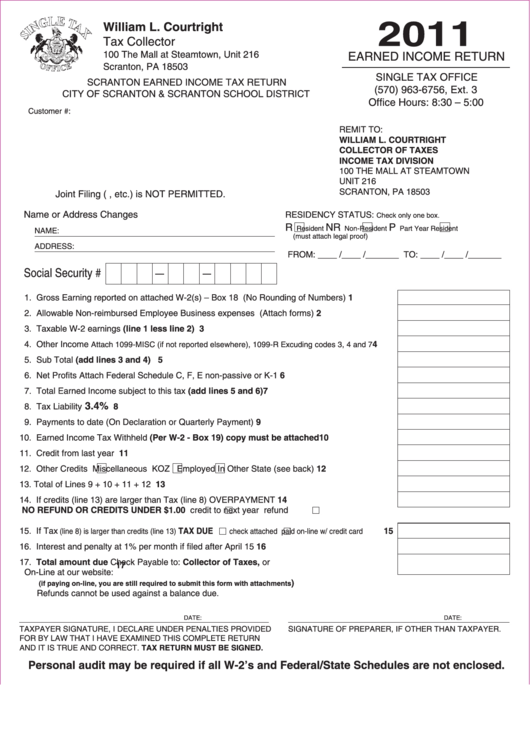

Scranton Earned Income Tax Return Form - Income Tax Division - 2011

ADVERTISEMENT

2011

William L. Courtright

Tax Collector

100 The Mall at Steamtown, Unit 216

EARNED INCOME RETURN

Scranton, PA 18503

SINGLE TAX OFFICE

SCRANTON EARNED INCOME TAX RETURN

(570) 963-6756, Ext. 3

CITY OF SCRANTON & SCRANTON SCHOOL DISTRICT

Office Hours: 8:30 – 5:00

Customer #:

REMIT TO:

WILLIAM L. COURTRIGHT

COLLECTOR OF TAXES

INCOME TAX DIVISION

100 THE MALL AT STEAMTOWN

UNIT 216

SCRANTON, PA 18503

Joint Filing (i.e. combining income, etc.) is NOT PERMITTED.

Name or Address Changes

RESIDENCY STATUS:

Check only one box.

R

NR

P

Resident

Non-Resident

Part Year Resident

NAME:

(must attach legal proof)

ADDRESS:

FROM: ____ /____ /_______ TO: ____ /____ /_______

Social Security #

1

1. Gross Earning reported on attached W-2(s) – Box 18 (No Rounding of Numbers)

2

2. Allowable Non-reimbursed Employee Business expenses (Attach forms)

3. Taxable W-2 earnings (line 1 less line 2)

3

4. Other Income

4

Attach 1099-MISC (if not reported elsewhere), 1099-R Excuding codes 3, 4 and 7

5. Sub Total

(add lines 3 and 4)

5

6. Net Profits

Attach Federal Schedule C, F, E non-passive or K-1

6

7. Total Earned Income subject to this tax (add lines 5 and 6)

7

3.4%

8. Tax Liability

8

9. Payments to date (On Declaration or Quarterly Payment)

9

10. Earned Income Tax Withheld (Per W-2 - Box 19) copy must be attached

10

11. Credit from last year

11

12

12. Other Credits

Miscellaneous

KOZ

Employed In Other State (see back)

13

13. Total of Lines 9 + 10 + 11 + 12

14

14. If credits (line 13) are larger than Tax (line 8)

OVERPAYMENT

NO REFUND OR CREDITS UNDER $1.00

credit to next year

refund

TAX DUE

15

15. If Tax

(line 8) is larger than credits (line 13)

check attached

paid on-line w/ credit card

16

16. Interest and penalty at 1% per month if filed after April 15

17. Total amount due Check Payable to: Collector of Taxes, or

17

On-Line at our website:

)

(if paying on-line, you are still required to submit this form with attachments

Refunds cannot be used against a balance due.

DATE:

DATE:

TAXPAYER SIGNATURE, I DECLARE UNDER PENALTIES PROVIDED

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER.

FOR BY LAW THAT I HAVE EXAMINED THIS COMPLETE RETURN

AND IT IS TRUE AND CORRECT. TAX RETURN MUST BE SIGNED.

Personal audit may be required if all W-2’s and Federal/State Schedules are not enclosed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1